Audit has always been about trust, accuracy, and compliance. But the methods and tools used are no longer the same as they were even a decade ago. With digital transformation reshaping industries, auditing is moving towards technology-driven practices. Blockchain Auditing, advanced analytics, and real-time reporting are becoming the foundation of how audits are conducted worldwide, including in the UAE. This shift is not optional anymore; it is shaping the skills auditors need, the way firms operate, as well as the expectations of businesses.

Continue reading the blog ‘Digital Transformation in Audit: Blockchain, Data Analytics, Real-Time Reporting’ to grab further insights on this.

Table of Contents

How Audit Processes Are Changing Globally and in the UAE

Traditionally, audits relied heavily on sampling and periodic checks. That approach made sense when data was limited and systems were paper-based. Today, businesses generate massive volumes of data, and stakeholders expect faster insights. Globally, audits are moving from static annual reviews to continuous evaluation. In the UAE, where regulations are tightening and businesses are scaling across borders, the expectation is for more transparent and timely reporting. Regulators are also encouraging the use of digital tools to improve reliability and reduce risks.

The UAE has taken a leading role in adapting to these global changes. Government-led digital transformation programs, such as smart government initiatives and blockchain adoption strategies, are influencing the way audits are carried out. For companies operating in free zones and mainland structures alike, the audit function is no longer just about financial compliance but, it is more about showing operational resilience and alignment with regulatory expectations.

Also Read: Transfer Pricing: What It Is, How It Works, and Real Business Examples

Blockchain Audit: Building Trust in Data

Blockchain technology is bringing new possibilities to assurance. Since it records transactions in an immutable ledger, it offers a transparent way to verify financial data. Here, auditors can check transactions directly at the source without relying only on reconciliations provided by clients. The benefit is clear: greater accuracy, fewer manual interventions, and stronger trust in reported numbers.

For global companies with operations in the UAE, blockchain audit is also significant because it helps bridge compliance with international reporting standards. Cross-border operations involve multiple financial systems, and blockchain ensures data integrity across all of them. The potential for error or manipulation is reduced, allowing auditors to focus more on analysis than on verification.

Also Read: Ultimate Beneficial Owner (UBO) Verification: The Complete Guide

Blockchain Auditing and Smart Contracts

One area gaining attention is blockchain smart contracts audit. Smart contracts execute transactions automatically when certain conditions are met. While this adds efficiency, it also introduces risks if the code is flawed or if security gaps exist. Auditing smart contracts requires both financial knowledge and technical skill to review coding logic, security vulnerabilities, and compliance with legal frameworks. This is where blockchain auditing extends beyond numbers, it joins technology with assurance.

In the UAE, smart contracts are particularly relevant for industries such as real estate, supply chain, and trade finance, where transactions are frequent and high-value. Auditors who understand how to assess these contracts provide clients with an added layer of security and confidence in their operations.

Also Read: UAE Announces Tax Update 2025: Key Changes Businesses Must Know

Data Analytics in Audit: Making Insights Practical

The volume of financial and operational data available to businesses is overwhelming. Nowadays, auditors are not just checking balances; they are analyzing patterns, anomalies, and risks hidden in datasets. Data analytics in audit allows firms to test entire populations rather than small samples. What this really means is better detection of irregularities, faster decision-making, and deeper insights for clients.

Internal audit and data analytics best practices now focus on integrating data tools early in the process, setting clear objectives for what to test, and ensuring data quality before drawing conclusions. In the UAE, where businesses often manage multinational operations, this approach is even more valuable. Auditors can evaluate consolidated financials in detail without being slowed down by manual processes.

Also Read: How to Claim a VAT Refund in the UAE: Step-by-Step Guide 2025

Real-Time Audit Reporting

The old model of waiting months for an audit report does not fit modern business needs. Real-time audit reporting enables auditors to provide ongoing updates as data flows in. This approach reduces surprises at year-end and gives management timely insights to act upon.

The difference between continuous auditing vs real-time reporting lies in scope: continuous auditing focuses on ongoing controls and compliance checks, while real-time reporting emphasizes delivering insights quickly to support business decisions. Both are becoming essential parts of the modern audit process. In the UAE, where companies are often subject to both local regulations and international compliance standards, the ability to report in real time is increasingly valuable.

Also Read: What Are the Different Types of Audit Reports?

Recent Trends in Auditing

Several trends are shaping the profession:

- Greater use of automation to handle repetitive tasks.

- Demand for cybersecurity audits as digital threats increase.

- Increased reliance on cloud platforms to manage audit workflows.

- Integration of artificial intelligence in testing large datasets.

- Expectation for auditors to provide assurance and insights into performance.

- Adoption of sustainability reporting as ESG requirements grow.

These trends are not isolated to global markets; they are visible in the UAE as well, where regulators and businesses are seeking digitization at a rapid pace. The demand for transparent financial data is rising, and firms that can provide these insights through technology are gaining a competitive edge.

Also Read: How To Choose The Best Audit Firms in Dubai – UAE

Audit Digital Transformation Trends 2025 (UAE)

Looking ahead to 2025, audit firms in the UAE will face three key shifts:

Regulation-Driven Technology Adoption

Compliance requirements will push firms to adopt blockchain and advanced analytics to improve transparency.

Talent Transformation

Firms will seek auditors with hybrid skills, finance plus data science.

Real-Time Compliance Monitoring

Businesses in the UAE, especially in financial services and free zones, will expect audit results delivered on demand.

The UAE is positioning itself as a regional hub for innovation in auditing, supported by government policies that encourage technology adoption. This transformation is not just about tools but it is also about mindset. Firms that adapt quickly will remain competitive, while others risk being left behind.

Also Read: Documents Required for VAT Registration UAE

Skills Audit Firms Are Looking For

The skills required for auditors are changing. Firms now value professionals who can:

- Work with data visualization tools.

- Understand blockchain applications in financial auditing.

- Apply AI as well as machine learning techniques to identify risks.

- Collaborate across teams, blending accounting knowledge with IT expertise.

- Communicate findings clearly to both technical and non-technical stakeholders.

In the UAE, where multilingual and multicultural workforces are common, communication and adaptability are also highly valued. Technical ability is becoming just as important as financial knowledge, reflecting the new nature of auditing where technology is embedded at every stage.

Also Read: The Three Golden Rules of Accounting

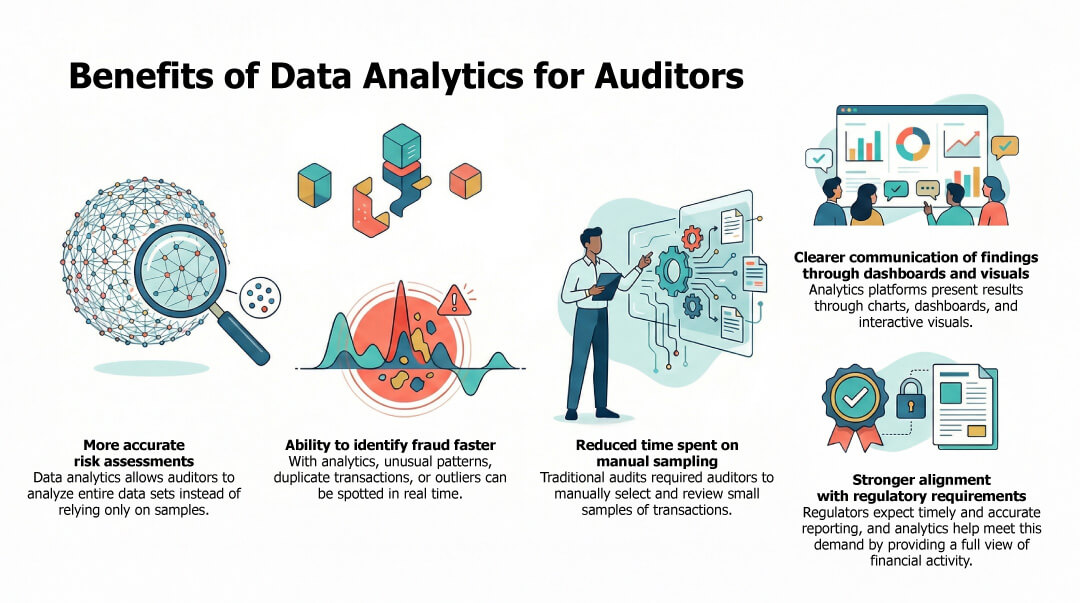

Benefits of Data Analytics for Auditors

The practical benefits of analytics are hard to ignore:

More Accurate Risk Assessments

Data analytics allows auditors to analyze entire data sets instead of relying only on samples. This broader view improves accuracy in identifying areas of potential concern, helping auditors focus on the risks that matter most.

Ability to Identify Fraud Faster

With analytics, unusual patterns, duplicate transactions, or outliers can be spotted in real time. This makes it possible to detect fraud earlier, reducing financial and reputational damage for organizations.

Reduced Time Spent on Manual Sampling

Traditional audits required auditors to manually select and review small samples of transactions. Analytics tools can scan all transactions automatically, saving time and allowing auditors to concentrate on interpretation and decision-making.

Clearer Communication of Findings Through Dashboards and Visuals

Analytics platforms present results through charts, dashboards, and interactive visuals. This makes it easier for management and stakeholders to understand findings quickly and take corrective action.

Stronger Alignment with Regulatory Requirements

Regulators expect timely and accurate reporting, and analytics help meet this demand by providing a full view of financial activity. Auditors can generate evidence-backed reports that align with compliance standards while reducing the risk of oversight.

Actually, data-driven audits do not just improve efficiency; they improve the value auditors bring to their clients. Firms can now move from being compliance checkers to strategic advisors. In the UAE, businesses are increasingly expecting this level of insight because it helps them stay competitive in international markets.

Also Read: Business Setup in Dubai: The Ultimate Guide to Company Formation in UAE

Challenges of Implementing Blockchain in Audit

While blockchain offers strong advantages, there are challenges to address:

- Standardization is still lacking across industries

Different industries and jurisdictions use blockchain in different ways, which makes it difficult to create a consistent audit approach.

- Auditors need new technical skills

Using blockchain for auditing requires knowledge of cryptography, distributed ledgers, and smart contracts, which many professionals are still learning.

- Integration with existing financial systems can be complex

Most companies still rely on traditional accounting systems, so connecting these with blockchain platforms often requires major adjustments.

- Legal frameworks are still catching up with the pace of technology

Regulations in many regions, including the UAE, are still evolving, which means auditors face uncertainty about compliance requirements.

- High costs of adoption for smaller firms

Implementing blockchain solutions often requires heavy investment in infrastructure and training, which can, in turn, be a barrier for smaller audit practices.

These challenges explain why blockchain adoption in audits is progressing step by step rather than overnight. Still, the momentum is clear, and audit firms are preparing for broader use. In the UAE, where the government actively promotes blockchain adoption, overcoming these challenges is a priority for both regulators and firms.

Also Read: How to Find TRN Number and Perform TRN Verification in UAE?

Future of Auditing: AI, Blockchain & Analytics

The future is about combining multiple technologies rather than relying on one. AI will support anomaly detection and predictive analytics. Blockchain will secure transaction data and smart contracts. Analytics will turn raw data into useful insights. Together, they will reconceive the audit profession into a more forward-looking function. Instead of simply validating the past, audits will increasingly guide future decision-making.

For Audit firms in the UAE, this shift will also align with the country’s vision of being a digital economy leader. Businesses will expect auditors to understand both accounting standards as well as technology ecosystems.

Also Read: What is ICV Certificate in Dubai-UAE and How to Get It?

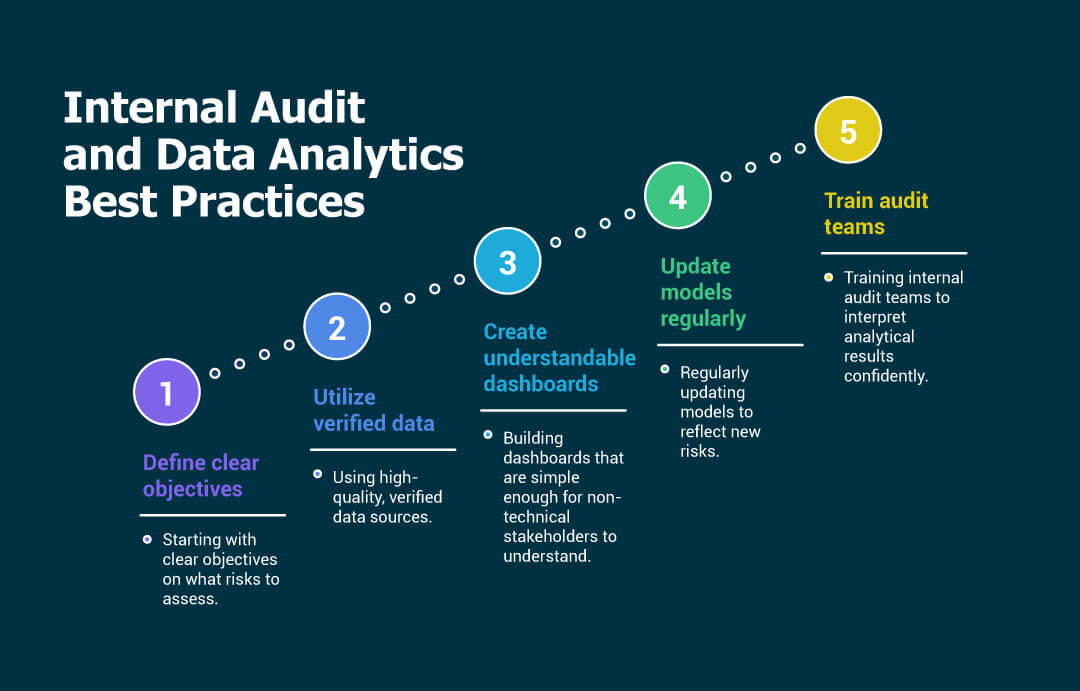

Internal Audit and Data Analytics Best Practices

For internal auditors, adopting data analytics requires discipline. Best practices include:

- Starting with clear objectives on what risks to assess.

- Using high-quality, verified data sources.

- Building dashboards that are simple enough for non-technical stakeholders to understand.

- Regularly updating models to reflect new risks.

- Training internal audit teams to interpret analytical results confidently.

By performing these practices, internal audits can become more reliable and relevant for decision-makers. For companies in the UAE, where businesses often operate in highly regulated industries like banking and healthcare, best practices in data analytics help reduce compliance risks and improve governance.

To recapitulate, auditing is changing fast, moving away from traditional checks to more tech-driven practices. With blockchain, data analytics, and real-time reporting, firms in the UAE can offer greater trust and timely insights. The future belongs to auditors who make use of these tools and bring real value beyond compliance.

Also Read: How to Register for Corporate Tax in UAE Using Emaratax