In the wake of recent amendments in UAE’s tax regulation, understanding and verifying the company’s Tax Registration Number, aka, TRN is crucial. Any business entity looking to dodge the possible legal issue should ensure their empire is registered for VAT in the UAE. Whether you are a consumer or a business owner, grasping how to verify the TRN is important to ensure the authenticity of transactions carried out, with respect to the VAT laws. It can prevent the company from finding itself in a situation where its reputation and goodwill are at stake. This blog will address why TRN verification is important in the UAE and how to do it. We will also provide a comprehensive guide on verifying TRN in the UAE.

Table of Contents

What is TRN in UAE?

The TRN is a unique 15-digit number provided by the FTA (Federal Tax Authority) to help differentiate companies. This distinctive code can only be attained after completing a business’s VAT registration.

Value Added Tax or VAT is a fixed amount of tax charged by registered businesses from their customers intending to pay back to the government. Businesses registered under UAE VAT are issued a TRN respectively and only those entities are supposed to charge the VAT from their customers. A VAT of 5% was introduced 6 years ago, and ever since companies have been imposing it on the customers, as per the provisions of the law.

Also Read: What Are the Different Types of Audit Reports?

Who Needs a TRN?

A TRN is necessary for entities engaging in commercial activities and registered under the VAT system to comply with tax regulations. It also helps report back to the FTA efficiently. The category includes local and foreign businesses that engage in taxable transactions in the country.

The requirement for a TRN is not limited to physical businesses but also to freelancers and self-employed individuals who conduct similar activities. Collecting a TRN can also help importers and exporters with customs clearance. In short, anyone providing taxable goods or services or generating taxable income should obtain a TRN to ensure their operations are legal.

Also Read: How To Choose The Best Audit Firms in Dubai – UAE

Importance of TRN in Dubai

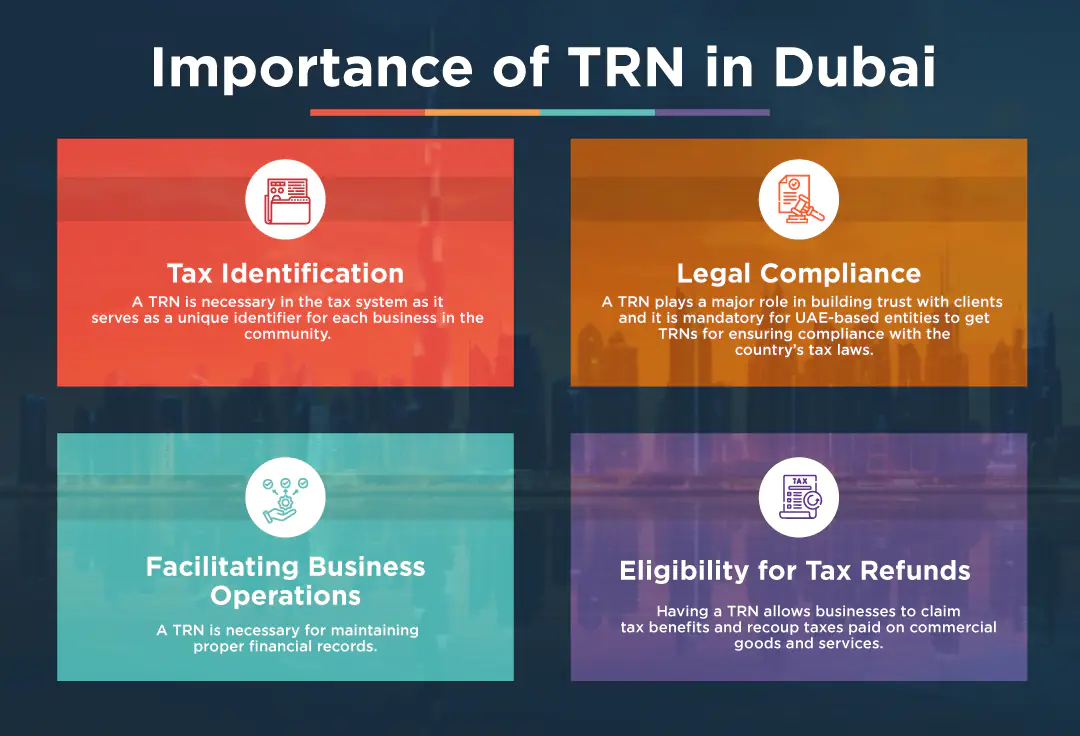

A TRN number is crucial in the UAE VAT system for numerous reasons:

Tax Identification

A TRN is necessary in the tax system as it serves as a unique identifier for each business in the community. Firstly, it simplifies the entire tax filing process and secondly, TRN reduces the workload of FTA in efficiently managing tax obligations.

Legal Compliance

A TRN plays a major role in building trust with clients and it is mandatory for UAE-based entities to get TRNs for ensuring compliance with the country’s tax laws. Companies without a TRN, even when the law mandates it, are likely to face legal repercussions, whereas, once received, this TRN helps maintain good standing with the authorities. Additionally, it also fosters accountability and transparency.

A TRN signals the professionalism of a business, boosting the trust and credibility of the company. Often, it indicates the transparency of the entity by making it compliant with tax regulations. It often symbolises the company’s commitment to ethical business practices, mostly helping them secure contracts and partnerships easily. Essentially, a TRN can also be a selling point that can be put forth to enhance the confidence of clients while also cancelling out any scepticism.

Facilitating Business Operations

A TRN is necessary for maintaining proper financial records. Besides reflecting on the financial transactions, it also sheds light on many other business operations, including contract negotiations and invoicing. Additionally, TRN can simplify interactions with government agencies that often ask for tax identification for validation. This ease in actions leads to ultimate growth and efficiency.

Eligibility for Tax Refunds

Having a TRN is beneficial in different ways. Businesses with credible TRN can make full use of tax benefits and companies can recoup taxes paid on goods and services purchased for commercial purposes. This can reflect hugely on the company’s profitability, especially a relief for small businesses.

Why is TRN Verification Important?

Considering the benefits mentioned above, there is always a risk of fraudulent practices such as using fake TRNs to conduct transactions. Initially, it wasn’t allowed for companies to deal with it themselves, but recently, the UAE government allowed citizens to carry on the verification processes through third parties. Unfortunately, some parties exploit the lack of knowledge of the business owners. So, having a good understanding is necessary.

When an entity is registered in the UAE, paying taxes to its government becomes compulsory on them. To keep track of the registered businesses, FTA often relies on TRN, and since that’s unique, it becomes easy for FTA to analyse what each company is doing. Usually, these businesses are required to pay a fixed sum to the government and to keep things easy and balanced, the registrants adjust the 5% VAT into their pricing. The money that’s collected in this manner is then directly transferred to the UAE government.

But, there is a huge room for foul play in this scenario. Unregistered companies do not have TRN and they are not allowed to collect VAT. But, since the government fails to keep an eye on these businesses, they fake their registration and TRN solely to collect cash in the form of VAT from customers. As such, this collected amount is unlawful to them. This makes a TRN check necessary.

Also Read: The Three Golden Rules of Accounting

How to Find TRN Number?

1. For individuals and businesses

- Check Personal Documents: TRN can be found on any tax-related papers like invoices, VAT registration certificates, or other documents from FTA. This number is supposed to be listed on at least any of these documents if not all.

- FTA Portal: TRN can be obtained from the registered account of the business. You have to click on the FTA’s official website and log in using your registered account. Once the profile window opens, your TRN should pop up somewhere on your profile or specifically under your registration details.

- FTA Mobile App: For this, the first step is downloading the FTA app. After logging in, you can find the TRN number in your registered account.

If you’re unable to locate your TRN by these methods, you can directly contact the FTA customer service or simply email them. They can guide you through the process to retrieve the TRN number.

2. For additional resources

- Tax Consultants and Advisory Firms

For anyone unfamiliar with the entire TRN concept, professional tax consultants in the UAE can come in to help. They can efficiently assist with TRN registration, verification, and other TRN-related issues.

- Business Registration Portals

After identifying the associated economic zone of your business, you can seek help from respective portals as they primarily focus on registration services and support.

Also Read: Documents Required for VAT Registration UAE

How to Do TRN Verification

Online Verification

Performing online verification is a straightforward method to ensure a company’s compliance with the country’s tax regulations. You are supposed to open the FTA’s official website and click on the ‘TRN’ on the right-side panel. Following that, you will be asked to provide the TRN number. When entering the 15 digits, it’s important to pay close attention to avoid unnecessary errors. After cross-checking the provided number, click the “Verify” tab, and then it will show the entity name that is linked to the TRN. The entity name displayed can be cross-verified with the available documents such as invoices to ensure authenticity.

If the TRN is not found, the system will immediately indicate the error and if you want further assistance with the verification, you may simply contact the FTA, and they will assist you with the requirements.

Performing the TRN verification online is not only less time-consuming but also more reliable.

TRN Verification Via Mobile

The second easy method to verify your TRN is via the FTA mobile app. To begin with, you have to download the app which is available on Google Play Store and App Store. Once installed, users are expected to log in using their registration credentials. If not registered, start with registering. You may be required to enter details like your email address, phone number, and TRN.

After completing the login process, scroll down to the TRN Verification section and enter your TRN number in the appropriate field. Again, users have to be careful while entering this unique number. Once entered, click on the “Verify” button. Within minutes, the app will process the results.

Manual TRN Verification

To manually verify your TRN, you have to keep all the details, including VAT registration certificates and other FTA correspondence in hand. Then, visit the official FTA website and go to their customer service. Depending on your preference, you can call them or email them requesting TRN verification. They might also ask for other information like the company name, address, and contact details.

If that doesn’t work, you can also visit the nearby FTA service centre in person. You have to bring a folder containing all the necessary tax documents and identity proofs. After sharing all the required details, they will assist you in verifying your TRN and resolving issues if any.

Also Read: Business Setup in Dubai: The Ultimate Guide to Company Formation in UAE

Conclusion

Understanding and verifying TRN is essential for both individuals and businesses engaging in taxable transactions in the UAE. It’s not just important for ensuring compliance with the tax regulations but it also plays a crucial role in enhancing the credibility of your business and ultimately leaving a good impression on the clients. As far as your income is taxable, having a valid TRN is paramount regardless of whether you are running a business or a freelancer. Regularly checking on the TRN verification status can help you avoid complicated situations in the future and safeguard your business against potential penalties.

Choose Kreston Menon: Your Tax Consultant for Comprehensive Tax Solutions

If you need assistance with tax consultation or TRN verification, you can easily contact a tax consultant in UAE, who can provide the best services.

Kreston Menon is a leading tax consultant in Dubai with years of experience in the field. Our trained team is dedicated to helping individuals and entities come face to face with the complexities of the UAE tax system. Whether you are seeking guidance on tax compliance or you want to find your TRN verification status, look no further than Kreston Menon, because we provide personalised support for you and we prioritise your satisfaction and peace of mind over anything.

Reach out to us immediately to schedule a consultation. We ensure this is your final step towards hassle-free tax management.

FAQs

- What actions are to be taken when a company fakes its TRN?

When a company is suspected or proven of using a fake TRN, it’s important to contact the FTA for further investigation and verification. An internal audit is also advised.

- Is the retrieval of a TRN number possible online?

Yes, retrieval of a TRN is possible and the feature is available on both the FTA mobile app and FTA’s official website.

- What are the documents required for TRN verification?

While verifying the TRN of a company or individual, the most important information required is its TRN number itself. Along with that, the name of the registered business may also be needed.

- How long after registration can TRN be obtained?

Following the application for VAT registration, the FTA takes a couple of days to process the TRN number. Typically, the TRN number is issued in 2-4 days.

- What should be done if a VAT registration certificate is lost?

In the case of a lost VAT registration certificate, one has to request a copy immediately through the FTA online account.