Transfer pricing might not be a term you hear every day, but it’s responsible for shaping how over half of global trade is taxed. In fact, more than 60% of international trade happens within multinational groups, between companies that are part of the same group but operate in different countries.

When these companies buy, sell, or license things to each other, they have to decide on a price. That price, called the transfer price, has a big impact on how profits (and taxes) are spread across countries. If the price is too high or too low, it could shift profits to lower-tax jurisdictions, which is exactly what tax authorities want to avoid.

That’s why most countries, including the UAE, now have rules in place to ensure these prices follow the “arm’s length” standard, which means the pricing should be similar to what unrelated businesses would use. With the UAE recently introducing its own corporate tax regime, transfer pricing has become an area that local businesses can no longer miss.

In this blog, let’s look at what transfer pricing really means, how it works, the common methods used, and how it connects with corporate tax compliance.

Also Read: Ultimate Beneficial Owner (UBO) Verification: The Complete Guide

What is Transfer Pricing?

Transfer pricing is the price one part of a company charges another part of the same company for goods, services, or use of intellectual property. These are not deals between strangers; they are internal. But even then, the prices need to make sense.

The transfer pricing meaning lies in the principle that companies should treat these internal transactions as if they were dealing with unrelated businesses; this is what is called the arm’s length principle. The price should be similar to what you would charge (or pay) if you were dealing with an independent party in a similar situation.

Also Read: UAE Announces Tax Update 2025: Key Changes Businesses Must Know

Why Is Transfer Pricing So Important?

At first glance, pricing between two branches of the same company might not seem like a big deal. But when those branches are in different countries, the way you price things internally can have a big impact on how much tax gets paid and where.

Why do tax authorities, including those in the UAE, take transfer pricing seriously? Let us look:

- Prevents profit shifting: Some companies might be tempted to move profits to countries with lower tax rates by tweaking internal prices. Transfer pricing rules are meant to stop that.

- For fair tax collection: If a business makes money in the UAE, the UAE should get its fair share of tax revenue. Fair pricing ensures that it happens.

- Promotes transparency: Clear and consistent internal pricing makes it easier for both businesses and tax authorities to stay on the same page.

- Supports fair competition: When everyone plays by the same rules, businesses compete fairly, and no one gets an unfair tax advantage.

- Aligns with international tax standards: Following global standards (like those from the OECD) helps businesses avoid being taxed twice on the same income and keeps them out of international tax trouble.

Also Read: How to Claim a VAT Refund in the UAE: Step-by-Step Guide 2025

Transfer Pricing and Corporate Tax: What’s the Connection?

Transfer pricing directly impacts corporate tax, especially in multinational businesses. When companies trade across borders with related entities, tax authorities want to make sure the pricing is fair and income isn’t being shifted around just to lower tax bills.

With the UAE rolling out its corporate tax system (effective from June 1, 2023), businesses operating locally and with international ties must now keep their transfer pricing in check. This includes having the right documentation, applying acceptable methods, and being able to explain how the prices were decided.

Also Read: What Are the Different Types of Audit Reports?

The Arm’s Length Principle in Transfer Pricing

Everything in transfer pricing revolves around the arm’s length principle. To put it in simple words, it means related companies should price their transactions just like unrelated businesses would.

For example, if a UAE-based parent company sells products to its subsidiary in India, the price charged should be similar to what the company would charge any other external customer. That way, each country gets its fair share of tax revenue.

Also Read: How To Choose The Best Audit Firms in Dubai – UAE

Common Transfer Pricing Methods

There is no so called general approach to transfer pricing. Depending on the type of transaction, companies can choose from a few globally accepted methods. Let us have a quick overview:

Comparable Uncontrolled Price (CUP) Method

This method compares the price of the related-party transaction to a similar transaction between unrelated companies.

Let’s consider an example: A UAE business sells machinery to its affiliate in Jordan. If it also sells the same machinery to an independent buyer in Saudi Arabia, the pricing from that deal can be used for comparison.

Resale Price Method

You start with the final resale price to a third party and subtract a typical gross margin. The remainder is considered the transfer price. This method works best when the distributor doesn’t add much value before reselling the product.

Cost Plus Method

This involves adding a standard profit margin to the costs incurred by the supplier. It is often used for manufacturing or service transactions.

Transactional Net Margin Method (TNMM)

Rather than looking at the price directly, this method focuses on net profit margins. You compare the profit earned from a controlled transaction to what similar independent businesses earn.

Profit Split Method

Here, the total profit from a transaction is split between the related entities based on how much value each one contributes. It is often used when the businesses are very closely connected in operations.

Each method has its place, and choosing the right one depends on the type of transaction, the roles each party plays, and how easy it is to find reliable data.

Also Read: Documents Required for VAT Registration UAE

Examples of Transfer Pricing

1. Using Intellectual Property

Imagine a US-based software firm licenses its app to its UAE subsidiary. The UAE office pays a royalty fee. That fee should reflect what any other unrelated business would pay for similar software.

2. Intercompany Loans

A parent company in the UAE lends money to its related company in the UK. The interest rate charged needs to be similar to what a regular bank would charge under the same conditions.

3. Internal Distribution

A UAE manufacturing firm sells products to its own distribution unit in India. The pricing should leave enough margin for the Indian unit to cover costs and earn a standard profit, just like any independent distributor would.

Thus, these examples show how important it is to get transfer pricing right, for both compliance and to avoid potential penalties.

Also Read: The Three Golden Rules of Accounting

What Are the Transfer Pricing Requirements in the UAE?

Under the new corporate tax laws, the UAE follows the global standards set by the OECD. Businesses here now have a few key responsibilities:

- Related Party Disclosures: Details of related-party transactions must be included in the tax return.

- Transfer Pricing Documentation: This includes two key reports:

- Master File: Gives an overview of the multinational group’s structure and pricing policies.

- Local File: Covers key aspects of local operations, including pricing strategies, benchmark analysis, and transaction records.

If your UAE-based business is part of a larger international group, there is a fair chance you will need to prepare this documentation to stay compliant.

Also Read: Business Setup in Dubai: The Ultimate Guide to Company Formation in UAE

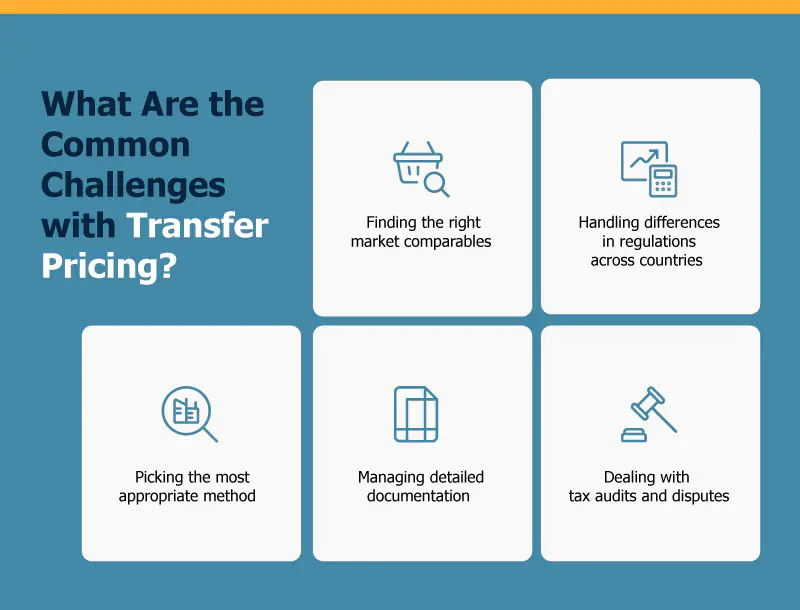

What Are the Common Challenges with Transfer Pricing?

Getting transfer pricing right isn’t always easy. Here are some of the issues businesses often face:

- Finding the right market comparables

- Handling differences in regulations across countries

- Picking the most appropriate method

- Managing detailed documentation

- Dealing with tax audits and disputes

That is why many companies work with UAE corporate tax consultants who specialize in this area, which can help businesses avoid mistakes that may cost them a lot.

Also Read: How to Find TRN Number and Perform TRN Verification in UAE?

The Role of Corporate Tax Services in UAE

With the introduction of corporate tax, businesses in the UAE have to pay more attention to how they handle transfer pricing. This is exactly when businesses can benefit from professional tax support. These firms offer:

- Help with evaluating risks in intercompany pricing

- Advice on setting up transfer pricing policies

- Support with benchmarking and economic analysis

- Assistance with documentation and reporting

- Guidance during tax authority reviews and audits

Having experienced advisors can make a big difference in making your company stay compliant and confident throughout the process.

Also Read: What is ICV Certificate in Dubai-UAE and How to Get It?

Make Transfer Pricing Simpler with Kreston Menon

Transfer pricing sounds technical, and maybe even a bit overburdening. But it doesn’t have to be, when

Kreston Menon is at play, as we believe that managing tax and compliance shouldn’t slow your business down. We help businesses like yours get the transfer pricing done right.

What working with us feels like:

- Your intercompany pricing is carefully reviewed to reflect market standards, keeping you in line with tax regulations.

- Our team takes care of the complete documentation process, including both Master and Local Files, which are designed to meet UAE tax regulations.

- We help identify the most appropriate transfer pricing method for your business and support it with accurate benchmarking.

- If you are facing an audit or tax review, we provide full assistance and representation to help you respond confidently and effectively.

Yes, Kreston Menon makes the whole process smoother and more strategic, like setting up your transfer pricing framework for the first time or refining an existing one. So, reach out to us at the earliest to stay ahead and compliant, always!

Also Read: How to Register for Corporate Tax in UAE Using Emaratax