Audit reports are more than just any formalities in a company; they are critical and reveal a company’s financial health and compliance with standards.

Regardless of size, large or small, every business relies on these reports to provide data on its financial health and internal controls. A well-written audit report provides valuable insight that aids banks, investors, and other stakeholders in making informed decisions. In this blog, we’ll explore the various types of audit reports and features and how you can obtain a favorable audit opinion.

Table of Contents

What Is An Audit Report?

Audit reports are formal documents that express the auditor’s opinion on the accuracy and consistency of a company’s financial statements. An auditor is a professional who observes a company to determine the assets and liabilities present in their finances. The results of this audit report will show a detailed overview of a company’s financial statements that are free from any misstatement.

The 5 C’s of audit report writing are Clarity, Conciseness, Completeness, Correctness, and Consistency, essential elements to ensure the report is clear, accurate, and comprehensive for stakeholders. Banks, financial institutions, investors, and creditors are all required to file an audit report. After the auditing, they will issue you with a clean report if you’re clean, and you will get an unqualified report if you have any financial statement errors. These audit reports are essential for all companies’ financial health.

Generally, audit reports can be divided into four categories: unqualified reports (clean), qualified reports, adverse opinions, and disclaimers of opinions. All these opinions provide a unique insight into the financial health of the company.

Also Read: How To Choose The Best Audit Firms in Dubai – UAE

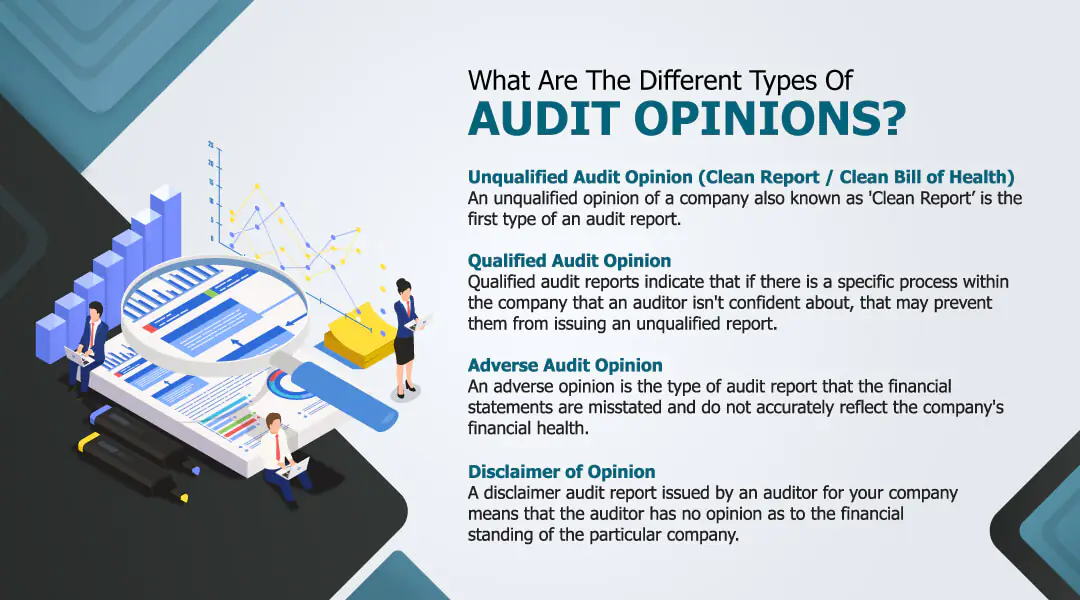

What Are The Different Types Of Audit Opinions?

In an audit report, you will find the auditor’s final assessment of your company’s financial statements. Based on the auditor’s findings, audit reports are divided into four types.

1. Unqualified Audit Opinion (Clean Report / Clean Bill of Health)

An unqualified opinion of a company also known as ‘Clean Report’ is the first type of an audit report. This means that the auditor has reviewed the company’s financial statements and determined that they are free of any type of misstatements and that the documents are prepared to comply with generally accepted accounting principles. In this way, the financial health of your company is now presented accurately without any exceptions. The company can now show the report to the public, which also comes as a positive sign for the company’s growth, overall confidence, and healthy financial reporting.

2. Qualified Audit Opinion

Qualified audit reports indicate that if there is a specific process within the company that an auditor isn’t confident about, that may prevent them from issuing an unqualified report. It’s like the financial report looks good, but there are a few points that need to be clarified. When companies receive a qualified audit report, they must address the identified issues to enhance their financial standing.

3. Adverse Audit Opinion

An adverse opinion is the type of audit report that the financial statements are misstated and do not accurately reflect the company’s financial health. This means there are significant errors, fraud, or non-compliance with the accounting of the company.

This type of report is rare and has significant implications that lead to a loss of confidence among investors, creditors, and regulators. It indicates that the company has failed to meet the accounting requirements, raising red flags about the integrity of the management team and the company’s financial controls.

4. Disclaimer of Opinion

A disclaimer audit report issued by an auditor for your company means that the auditor has no opinion as to the financial standing of the particular company. When the auditor arrives at a company, the company needs to give them proper access and effective auditing documents. This will happen if the auditor doesn’t get any access to documents or satisfactory answers during their audit; they issue a disclaimer of opinion to the company. If the company gets this type of audit report, that can harm the company’s reputation and hinder its growth.

Common Features Of An Audit Report

Title

The audit report starts with a title called “Independent Auditor’s Report,” showing it from an unbiased third party.

Address

An audit report is usually addressed to the company’s shareholders or board of directors.

Responsibilities of the Auditor and Management

This section displays the roles of the company’s management and the auditor. The management of the company is responsible for setting up the financial statements of the business and the auditor’s duty will be to provide an independent opinion.

Scope of the Audit

The report specifying the standards followed and describing the procedures conducted during the audit. It also confirms any error assessments and procedures as well as the limitations of the audit scope.

Opinion of the Audit

This is where the auditor’s overall conclusion comes regarding the financial statements, whether it’s an unqualified (clean), qualified, adverse, or disclaimer opinion.

Basis of Opinion

This section provides the rationale behind the auditor’s opinion, explaining the audit process, any limitations, and the reasoning behind the judgment made.

Signature of the Auditor

The auditor’s signature is used to complete and authenticate the report, indicating responsibility.

Place of Signature

In place of signature, the auditor needs to add where the audit report was conducted and signed.

- Date of the Audit Report

Here, they will add the date when the auditor completed the audit work and finalized the report.

- Date of Signature

The exact date on which the auditor signed the report, confirming its issuance.

Also Read: How To Choose The Best Audit Firms in Dubai – UAE

How You Can Obtain A Favorable Audit Report?

Here are some points that you can look at in your next financial audit of your company.

Accurate financial reporting

You have to maintain a well-organized and transparent financial reports of your company. Make sure all your statements comply with the accounting standards. You can review these records once in a while to maintain its accuracy and consistency and you can know if there are any errors in it.

Also Read: The Three Golden Rules of Accounting

Implement strong internal controls

Doing good internal controls protects your financial data from fraud or mismanagement in your business. This includes monitoring cash flows and expenditures and reporting other revenue. Regular Internal audits or regular financial reviews can help identify issues early, reducing the likelihood of material misstatements during an external audit.

Also Read : Documents Required for VAT Registration UAE

Build a Collaborative Relationship with Your Auditor

You can clearly communicate with your auditor to set up a smooth audit process in your company. When they are auditing you can actively give them what they want and make a collaborative relationship with them. These will help in clarifying any discrepancies and reduce the risk of any limitation that could lead to a disclaimer of opinion.

Also Read: What is ICV Certificate in Dubai-UAE and How to Get It?

Address Issues from Past Audits

If your company has received qualified or adverse opinions in the past, it’s vital to address the underlying issues that led to those reports. Whether it involves fixing accounting errors, improving documentation, or resolving compliance issues, demonstrating that your company has taken corrective action can improve the chances of receiving a clean opinion in the future.

Also Read: Business Setup in Dubai: The Ultimate Guide to Company Formation in UAE

Conclusion

A favourable audit report goes a long way in building trust with investors, banks, and other stakeholders. You can contact a professional audit service firm like Kreston Menon if you require auditing services for your business. As a professional auditing firm in the UAE, Kreston Menon is dedicated to safeguarding the interests of all stakeholders. By committing to professionalism, we provide the best auditing services available.