Age of Technology

Data is the new oil of the world. The business inputs that can be derived from the data points and acting upon it makes or breaks a company in today’s world. It has become a reality that technology has taken over the mundane tasks that has had the brilliant human minds at stake. The impact of Artificial Intelligence on our lives both professionally and personally cannot be ignored or avoided.

In such an era, it is natural to be worried since it is rendering humans redundant but at the same time it is imperative to understand that the technology is also making us smart by freeing us up to do the more high-yielding work. Who would have anticipated that we could make complex calculations in few seconds or for that matter open a bank account just by talking to a virtual assistant?

Tackling VAT Compliance using Technology

VAT as a subject has been relatively new to the GCC region and being a consumption-based tax, puts a lot of onus on businesses for compliance. With a staggered mode of collection across the supply chain, businesses step into the role of custodians of government revenue for collecting and depositing taxes. With this role of custodianship, comes the responsibility of being 100% accurate and to do justice to this responsibility, a lot of businesses end up investing significant amount of resources – not just monetary but also, time. Many businesses may still not feel confident about their VAT returns, despite the amount of resources put in, because:

- System set-up issues

- Multiple sources of data

- Time lags

- Inter-dependency on numerous people, across departments

- Human intervention in ERP

- FTA updates, etc

Businesses today have started their migration towards technology and automation within their organisation changing their work style and sometimes line of business. Evidently, organizations resort to machines as they are especially good at repetitive actions, don’t get tired, avoid mistakes and react in a speedy manner. Much of the inhouse functions in an organization are automated and Value Added Tax (‘VAT’) compliance is not an exception. Most of the big organizations continue to employ large numbers of people in VAT departments whose roles are very process oriented.

For example;

- Repeatedly engaged in requesting for information and data from within their own organization’s business verticals;

- Aligning the date in case the date is not provided in the specified format, manually;

- Spending time in checking, adjusting the data to ensure the accuracy of VAT returns, manually;

- Preparation of Group VAT returns, manually;

- Preparing VAT reports, manually; and

- Reconciling the VAT returns prepared with chart of accounts, manually.

lmagine there is a system which does all such tasks with least human intervention for carrying out data and analytics testing. This system does not have sick leaves or family time, it can work 24*7, 365 days a year. This is our tax engine, VAT eGenie.

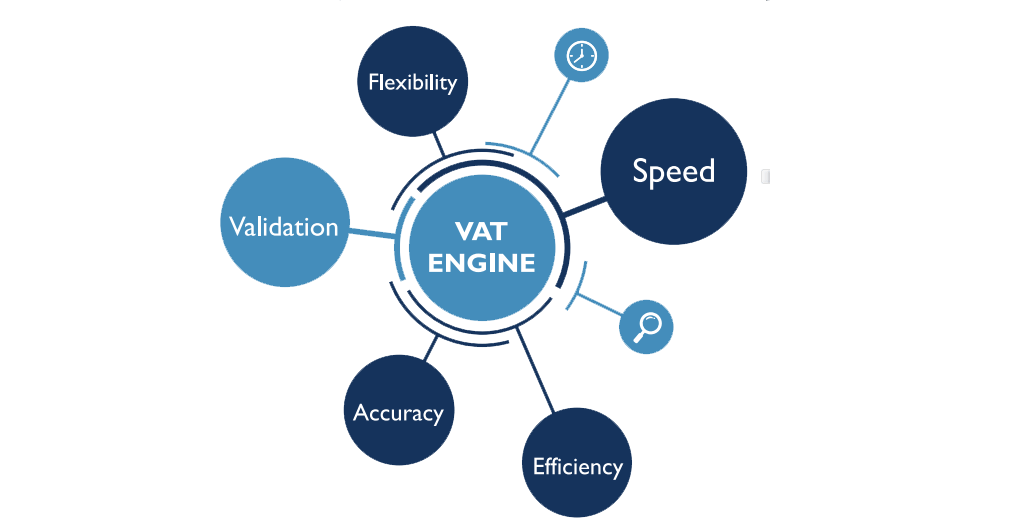

It must be understood that the tax engines are not rigid and can be customized to meet the requirements of each specific businesses across multiple systems. What may look complex today can be broken down into multiple pieces and fixed on the click of a button.

How would it help your company and people?

- One-time set-up, post which the engine sits on an auto pilot mode;

- Reduction of human intervention reducing errors;

- The Tax engine can also integrate with your inhouse ERP software supporting collation of data

from multiple sources;

- Regular updates released by FTA, which helps in ensuring your business is updated;

- Timely VAT reporting (even daily possible)

- Accuracy and transparency of tax returns

- Reconciliations (multiple of them, GL, Customs data etc)

Is your organisation ready for a change?

There is never a right time to be ready, it is a process and the companies that start early will benefit the most from it. Even we as consumers were initially more cautious towards making online payments or swiping our credit cards as we were concerned about the safety of our bank details. However, advances in digital security have reduced those concerns and now digital payments have become an important part of our daily life.

The FTA has adopted technology by making available the submission, payment and filing online without a single paper to be submitted physically. This requires the companies to also be ready to embrace a digital approach for Tax Compliance.

Tax engine is not going to result into savings, accuracy and optimization if we mull over it without taking any action. What will set you apart as a company is your approach towards tackling VAT compliance with technology