1. Introduction to UAE’s E-Invoicing Framework

The United Arab Emirates (‘UAE’) is embarking on a transformative journey in its tax administration landscape with the introduction of a nationwide Electronic Invoicing System (EIS). This initiative, spearheaded by the Ministry of Finance (‘MOF’) and the Federal Tax Authority (FTA), aims to digitize the issuance, exchange, and storage of invoices in a structured electronic format. The legal foundation for this reform is laid out in Ministerial Decisions No. 243 and 244 of 2025, which define the scope, obligations, and phased implementation of e-invoicing across the country.

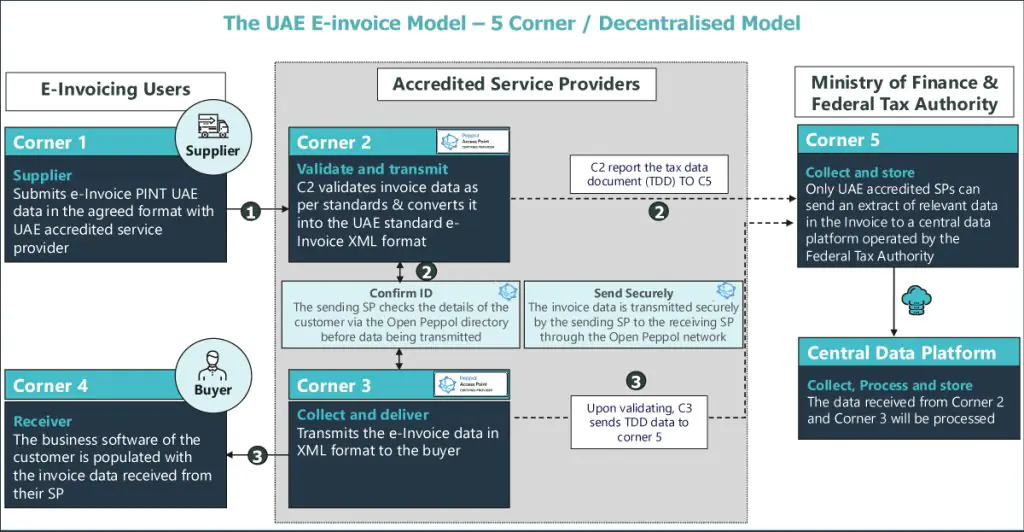

Under this system, an electronic invoice is not merely a scanned copy or PDF; it is a machine-readable document—typically in XML or UBL format—transmitted through accredited service providers using the Peppol network. The goal is to enhance transparency, reduce fraud, and streamline VAT compliance. The system applies to all VAT-registered entities conducting business-to-business (B2B) and business-to-government (B2G) transactions.

However, certain transactions are excluded from the scope of e-invoicing. These include:

• Transactions conducted by government entities in a sovereign capacity.

• International passenger transport services with electronic tickets and ancillary airline services.

• International transport services with airway bills, temporarily excluded for 24 months.

• Financial services that are exempt or zero-rated under UAE VAT law.

• Business-to-consumer (B2C) transactions, which are currently outside the mandatory scope.

2. Implementation Timeline and Compliance Requirements

The rollout of e-invoicing in the UAE is designed to be gradual, allowing businesses ample time to prepare. A voluntary pilot program will commence on July 1, 2026, for entities that meet the technical prerequisites. Mandatory compliance will follow in phases based on the size and nature of the business:

• Businesses with annual revenue equal to or exceeding AED 50 million must appoint an Accredited Service Provider (ASP) by July 31, 2026, and begin issuing e-invoices from January 1, 2027.

• Other businesses with revenue below AED 50 million must appoint an ASP by March 31, 2027, and comply by July 1, 2027.

• Government entities are expected to comply by October 1, 2027.

All e-invoices must be issued within 14 days of the taxable transaction and stored within the UAE. Businesses are required to report invoices and credit notes to the FTA through their ASPs. The system also permits self-billing and agent-based invoicing, provided both parties are VAT-registered.

3. Benefits and Strategic Advantages of E-Invoicing

The shift to e-invoicing offers a multitude of benefits for UAE businesses. First and foremost, it enhances operational efficiency by automating invoice generation, validation, and transmission. This reduces manual errors, accelerates payment cycles, and lowers administrative costs.

Moreover, e-invoicing improves financial transparency and data accuracy. Businesses gain access to real-time insights into their transactions, enabling better decision-making and audit readiness. The structured format of e-invoices also facilitates seamless integration with ERP systems, allowing for automated compliance and reporting.

Another strategic advantage lies in cross-border compatibility. Since the UAE’s system is based on the Peppol network, businesses can exchange invoices with international partners using the same standards, thereby simplifying global trade operations. For SMEs, this levels the playing field by providing access to advanced invoicing technology at a manageable cost.

4. Comparative Analysis: UAE vs Global E-Invoicing Models

While the UAE’s e-invoicing system is ambitious and forward-looking, it differs significantly from models adopted in other countries. Understanding these differences is crucial for multinational businesses and advisors.

Saudi Arabia, for instance, uses a centralized clearance model under its FATOORA system. Invoices must be submitted to the Zakat, Tax and Customs Authority (ZATCA) for real-time validation before being shared with buyers. This model ensures tight control and immediate oversight but can be more rigid and technically demanding for businesses.

India’s e-invoicing system, governed by the Goods and Services Tax Network (GSTN), also follows a clearance model. Businesses must generate invoices through government-authorized portals, which assign unique Invoice Reference Numbers (IRNs) and QR codes. While effective in curbing tax evasion, the system is heavily reliant on centralized infrastructure and may pose integration challenges for smaller firms.

The European Union, where Peppol originated, has adopted a variety of models. Countries like Belgium and Denmark mandate Peppol for B2G transactions, using either centralized portals or open access points. The Netherlands and Germany have integrated Peppol into their national procurement systems, ensuring seamless public sector invoicing.

In contrast, the UAE has opted for a decentralized “five-corner” model built on the Peppol network. Here, invoices are validated and exchanged through accredited service providers, with the FTA receiving transaction data post-validation. This approach offers greater flexibility and scalability, especially for cross-border transactions, and aligns with global interoperability standards

What sets the UAE apart is its hybrid approach: it combines the global Peppol standard with localized compliance rules, such as mandatory ASP accreditation and UAE-specific data dictionaries. This ensures both international compatibility and domestic regulatory alignment.

Conclusion

The UAE’s e-invoicing initiative marks a significant milestone in the country’s digital transformation journey. By replacing traditional invoicing methods with a standardized, secure, and automated system, the government aims to foster greater transparency, efficiency, and compliance in the business ecosystem. For companies operating in the UAE, this is an opportunity to modernize their financial operations, reduce costs, and align with global best practices.

However, success will depend on timely preparation, strategic planning, and a clear understanding of the regulatory landscape. As the implementation deadlines approach, businesses must act proactively to ensure a smooth transition into this new era of digital tax compliance. Moreover, understanding how the UAE’s model compares with other jurisdictions can help businesses navigate cross-border operations more effectively and leverage the full potential of e-invoicing.