While the fundamental aim of measuring profit aligns across commercial accounting practices and tax regulations, different countries apply distinct tax and accounting rules. Some nations closely link accounting income with taxable income, while others have self-contained tax laws. In the UAE, accounting net profit forms the basis for determining taxable income for corporate tax purposes. The UAE Corporate Tax Law (‘UAE CT Law’) provides that the Taxable Income of each Taxable Person shall be determined separately, on the basis of properly prepared, standalone Financial Statements for financial reporting purposes in accordance with the Accounting Standards accepted in the UAE for Corporate Tax purposes.

Accounting Standards and Accounting Profit

Accounting profit, also known as financial profit or bookkeeping profit, represents a Company’s net income derived from its operational and non-operational activities. It is calculated by subtracting total expenses from total revenue and serves as a key metric for assessing profitability and comparing financial health with industry peers.

Accounting Standards

According to Article 20(1) of the UAE CT Law, Taxable Persons are obligated to prepare financial statements in compliance with the applicable accounting standards within the country. As International Financial Reporting Standards (IFRS) are in effect in the UAE, taxable persons must adhere to IFRS guidelines for their financial reporting. Ministerial Decision No. 114 of 2023 specifies that the only Accounting Standards accepted in the UAE for Corporate Tax purposes are the International Financial Reporting Standards (“IFRS”) and the International Financial Reporting Standard for Small and Medium- sized Entities (“IFRS for SMEs”). Taxable Persons may use IFRS for SMEs if they derive Revenue not exceeding AED 50,000,000 in a Tax Period.

Basis of accounting

IFRS stipulates that financial statements should be prepared using the accrual basis of accounting. However, Article 20(5)(a) authorizes the Minister to establish circumstances and conditions under which financial statements may be prepared using the cash basis of accounting. Taxable Persons can apply to the Federal Tax Authority (FTA) for transitioning from accrual basis to cash basis accounting. Upon approval by the FTA, these changes will take effect from the commencement of the tax period in which the application is submitted or from a future tax period.

In accordance with Article (2) of Ministerial decision No. 114 of 2023, a Taxable Person may prepare Financial Statements using the Cash Basis of Accounting if:

• Their Revenue does not exceed AED 3 million within the relevant Tax Period; or

• In exceptional circumstances and pursuant to an application submitted by the Taxable Person to the FTA.

Audited financial statements

Ministerial Decision No. 82 of 2023 has been published specifying that a Taxable Person deriving Revenue exceeding AED 50,000,000 (Fifty Million United Arab Emirates Dirhams) during the relevant Tax Period as well as a Qualifying Free Zone Person shall prepare and maintain audited financial statements.

Relief for Small Businesses

Article 21 of the UAE CT Law offers tax relief for small businesses, allowing tax resident entities with Revenue not exceeding AED 3,000,000 in a relevant Tax Period and all previous Tax Periods that end on or before 31 December 2026 to elect for Small Business Relief thereby deeming that the entity has not derived any taxable income.

Adjustments to accounting profits

As per Article 20 of the UAE CT Law, the Taxable Income for the tax period is the net profit or loss reported in the financial statements, after making adjustments as necessary, for the following items:

Unrealized gains or losses

Taxable Persons who prepare their financial statements on an accrual basis will have an option to avail realisation basis treatment of unrealized accounting gains or losses for tax computation. If the Taxable Person decides to avail the benefit of taxing unrealised gains and losses on realisation basis, they are obliged to choose between the following options:

Option 1 – the taxpayer can elect to recognize gains and losses for all assets and liabilities only when they are realized.

Option 2 – the taxpayer can elect for the realization basis to apply only to assets and liabilities held on capital account. Gains and losses on other assets and liabilities would be included in taxable income on a current basis.

Exempt Income

Exempt income under Article 22 encompasses dividends, qualified participation relief dividends, select foreign permanent establishment income, and specific non- resident income related to operating ships and aircraft.

Qualifying Group Exemptions

No gain or loss needs to be considered in determining the Taxable Income in relation to the transfer of one or more assets or liabilities between two Taxable Persons that are members of the same Qualifying Group i.e two or more Taxable Persons who satisfy specified conditions including, but not limited to, common shareholding of 75%.

Business Restructuring Relief

No gain or loss needs to be taken into account in determining Taxable Income in relation to business restructuring transactions, subject to specified conditions.

General expenditure deduction

In accordance with Article 28, Expenditure incurred wholly and exclusively for the purposes of the Taxable Person’s Business that is not capital in nature shall be deductible in the Tax Period in which it is incurred, subject to the provisions of this Decree-Law. Accordingly, the Taxable Person needs to ensure that the expenditure is carefully evaluated to ensure the business purpose of such expenditure and the capital or revenue nature thereof. Further, if any expenditure serves multiple purposes, a deduction is allowed for the identified business purpose of such expenditure or a reasonable portion of such expenditure determined based on a fair and reasonable basis.

Interest expenditure

The general interest deduction limitation rule, according to Article 30, restricts interest expenditure deduction to 30% of Earnings Before Interest, Tax, Depreciation, and Amortization (EBITDA). This limitation doesn’t apply to banks,certainfinancialinstitutions,insurancebusinesses, and individuals. Ministerial Decision No. 126 of 2023 further extends the exemption from this rule to Taxable Persons whose Net Interest Expenditure does not exceed AED 12,000,000 (Twelve Million Dirhams)

Article 31 also prescribes specific non-deduction for interest expenditure on loan obtained from Related Parties, used for certain specific purposes laid down in the UAE CT Law.

Entertainment expenditure

Article 32 lays down special rules governing entertainment expenses, limiting deductions to 50% of the cost. These expenses encompass spending for entertaining customers, shareholders, suppliers, or business partners, including meals, accommodation, transportation, admission fees, facilities, equipment, and other expenses of similar nature.

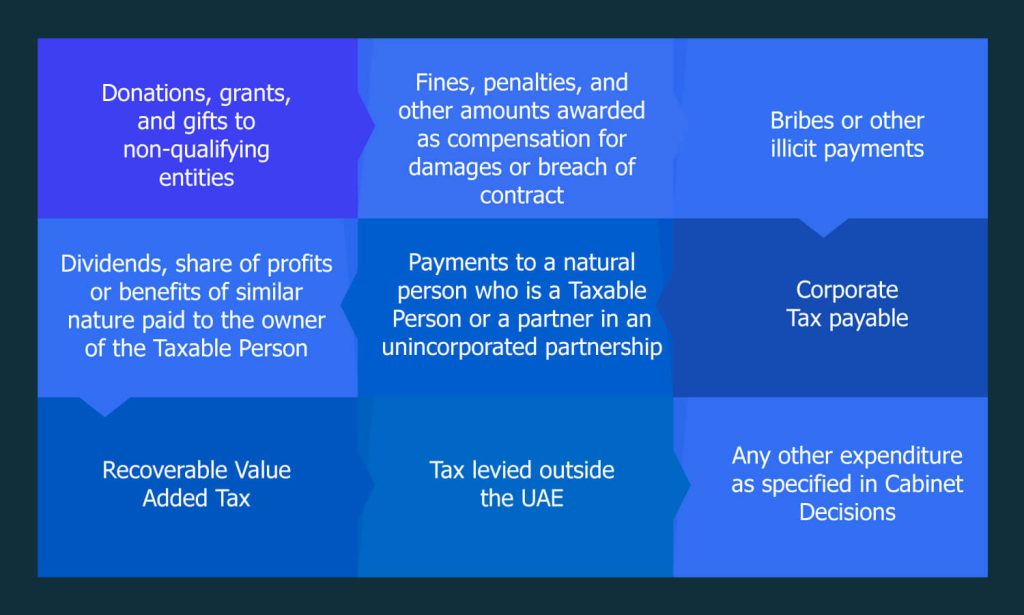

Non-deductible expenditure

Article 33 specifies expenditure that are not deductible for the purposes of computation of Taxable Income. This includes:

Transactions with Related Parties and Connected Persons

Article 34 of the UAE CT Law stipulates that transactions and arrangements between Related Parties must meet the arm’s length standard. Further, Article 36 of the UAE CT Law specifies that a payment or benefit provided by a Taxable Person to its Connected Person shall be deductible only if and to the extent the payment or benefit corresponds with the Market Value of the service, benefit or otherwise provided by the Connected Person and is incurred wholly and exclusively for the purposes of the Taxable Person’s Business.

Accordingly, necessary adjustments may have to be made to the taxable income if the transactions with related partiesandconnectedpersonsarenotcarriedoutinline with the Arm’s Length Principle.

Loss relief

Chapter 11 of the UAE CT Law specifies that a Tax Loss can be offset against the Taxable Income of subsequent

Tax Periods to arrive at the Taxable Income for those subsequent Tax Periods. Specific rules have been made in relation to conditions to be satisfied for such set off and transfer of losses within the group.

Conclusion

In conclusion, adherence to accounting standards accepted in the UAE is crucial for businesses to accurately determine their taxable income. While there may be differences between commercial accounting practices and tax rules globally, the UAE aims for alignment to international standards, promoting efficiency and reducing compliance costs. Understanding the provisions outlined in the UAE CT Law ensures proper treatment of adjustments such as unrealized gains or losses, exemptions, reliefs, and deductions. Additionally, the flexibility provided for changes in accounting methods underscores the importance of compliance with the law over conflicting accounting standards.