Mankind and Inventions

Mankind has always found solutions to the problems at hand or have invented ways to make their life easier. Be it from the primitive age when fire was invented or rather discovered, or the invention of the wheel which revolutionized the world. There are many enthralling stories of inventions like the electrical bulb, aeroplanes and motor cars. But I would like to draw your attention to more than couple of thousands of years ago, when King Hieron engaged hundreds of people to launch Syracusia, a 55 meters long ship, which can rival the most luxurious modern cruises like RMS Queen Mary 2 or the Harmony of the Seas. Despite the physical labour of hundreds, they couldn’t get the vessel into the sea. That was when Archimedes who proclaimed, “Give me a place to stand and I will move the world” came into the picture. He built a pulley system that allowed him to single-handedly move the ship and set it on to the path for many voyages across the oceans.

Financial Services and Technology

Archimedes managed to invent and use technology to solve a problem, and today we have advanced technology to help

us make financial services more efficient and effective. That technological backbone is called Fintech.

In the 1970s, automated teller machines (ATMs) changed the way people banked. Later, credit cards and internet changed the way people purchase goods and services. Then, it was the penetration of smartphones that radically changed the way consumers interact with business. Today, Fintech is changing the way people do business.

With the increased use of smart phones and the development of appropriate interactive tools and platforms, Fintech has captured the market, offering products and solutions for which banks once claimed that there can be no substitution such as e-payments and online trading.

While Fintech companies were initially viewed as a competitor by banks, the two are now benefitting from working together. The World Retail Banking Report says, 91 percent of banks and 75 percent of Fintechs expect to partner with banks in the near future.

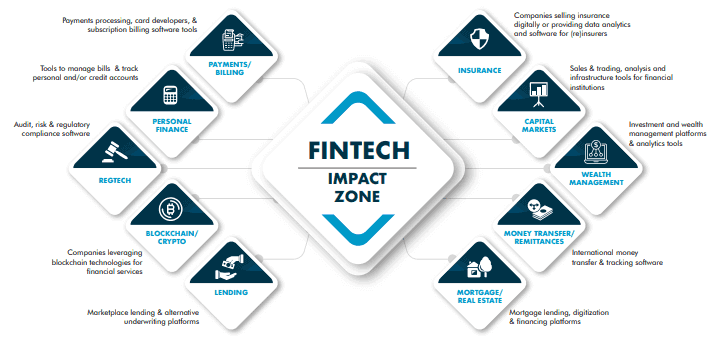

Today, Fintech disruptors are changing the face of financial services. For every aspect of transactions – be it lending, credit, payments and insurance – banks and traditional financial institutions are either partnering with Fintech companies or developing their own solutions.

Integrating Fintech & Banking

Application Programming Interface (API) is driving this evolution. Once a jargon only used by technical experts, APIs are becoming part of our everyday vocabulary as they provide more capabilities and opportunities for Fintech companies and financial institutions to work together and serve their customers better.

In an era, where institutions strive to be customer-focused and want to create a superior customer experience this technology ensures simple, frictionless experiences for their customers. Open banking allows banks to share data with third-party companies or applications securely and in real time, using APIs. The emergence of APIs and Open Banking has changed the image of traditional banking being slow by providing fast and secure banking experience for the customer.

TRENDS TO WATCH

New Regulations

Payment Services Directive 2.0 (PSD2) is the legislation made to create a single market for payments in the European Union and is considered as a giant step to ensure more protection to customer data. PSD2 will end the monopoly of banks on their customer’s data. It will allow merchants like Amazon, to retrieve customer account data from their bank – with your permission. That means when the customer buys something from Amazon, the payment can be direct, without having to redirect the customer to another service like Visa or PayPal. The changes in the directive will enable Account Information Service Providers to access, compare and process data from multiple bank accounts of a single customer. PSD2 will also require stronger identity checks when paying online, particularly for high value transactions.

It is noteworthy that both the General Data Protection Regulation (GDPR) and the PSD2 took effect simultaneously.

September 14, 2019 is the final deadline for all EU corporations to comply with PSD2’s Regulatory Technical Standard (RTS).

Regulation Technology (RegTech)

As Fintech has to adhere to regulatory compliance, financial institutions are investing in technology to sync the regulatory process with the transactions. Machine Learning (ML) algorithms can help banks to comply to the regulatory standards of controlling bodies like central banks, GDPR (General Data Protection Regulation), etc.

Blockchain Adoption

Though there has been much hype and much more confusion about blockchain technology, Fintech is exactly the industry that is influenced by blockchain. According to a study by PwC, 77% of Fintech companies will adopt blockchain by 2020. The blockchain records transactions and updates the digital ledger online without anyone having complete access to the data stored.

Mobile Pay

Mobile banking is showing a strong upward trend with 36% of smartphone users using payment apps like Paypal, Apple

Pay, Venmo and Google Wallet. QR code scanners and NFC (Near-field communication) devices in many points of sales

(POS) make mobile transactions so convenient.

AI, NLP, IoT and RPA

Artificial Intelligence is revolutionizing individual financial planning, fraud detection (AML) and process automation. This technology not only enhances the efficiency of financial sector by eliminating human interference but also has proved to be valuable for maintaining the supply chain, reducing the risks of cyber-attacks. NLP (Natural Language Processing), a branch of AI, can help the digital banking customer support by processing a large number of queries with the aid of virtual customer assistants (VCA) or chatbots.

By integrating Internet of Things (IoT) into Fintech, banks and other financial institutions are enhancing the customer experience as well as ensuring data protection. Robotic Process Automation (RPA) software will automate

human efforts and eradicate human error. Studies say that by 2020 there will be rapid acceptance in the financial service sector to adopt technologies that use bots, automation of employee duties and workflow construction.

Voice Recognition

After Siri and Alexa became popular among smart phone users, modern banks are now implementing AI-driven voice

technologies to help customers make easy and secure banking transactions. Already major banks are using voice recognition as a reliable authentication method for your bank account.

Fintech Tomorrow

The financial space has changed significantly in the past decade with the emergence of new technologies and increased competition in the marketplace. Today, bankers see the rise of Fintech as an opportunity to expand products and services as well as ensure customer satisfaction.

Digital disruption has the potential to shrink the role and relevance of today’s banks, but they are shaking themselves out of institutional complacency and recognize that merely navigating waves of regulation and waiting for interest rates to rise won’t protect them from obsolescence. Embracing openness and collaboration will be the key