Under the Organization for Economic Cooperation and Development – OECD/G20 Inclusive Framework on BEPS, over 135 countries are collaborating to put an end to tax avoidance strategies that exploit gaps and mismatches in tax rules to avoid paying tax. On 30 April 2019, the UAE Cabinet issued the Cabinet of Ministers Resolution No. 31 of 2019 concerning Economic Substance Regulations (ESR) requiring all in-scope UAE entities to comply with the Inclusive Framework on Base Erosion and Profit Shifting (BEPS) to ensure that profits are accounted by the entities where the actual economic activities are conducted and value created. The Ministry of Finance (MoF) of UAE released a Ministerial Note on the application of the regulations on 11 of September 2019 and another guidance note, the Relevant Activity Guide (RAG) on 15 April 2020 in their continued efforts to clarify the scope and coverage of listed economic activities and their associated Core Income Generating Activity test (CIGA).

Is ESR applicable to your company?

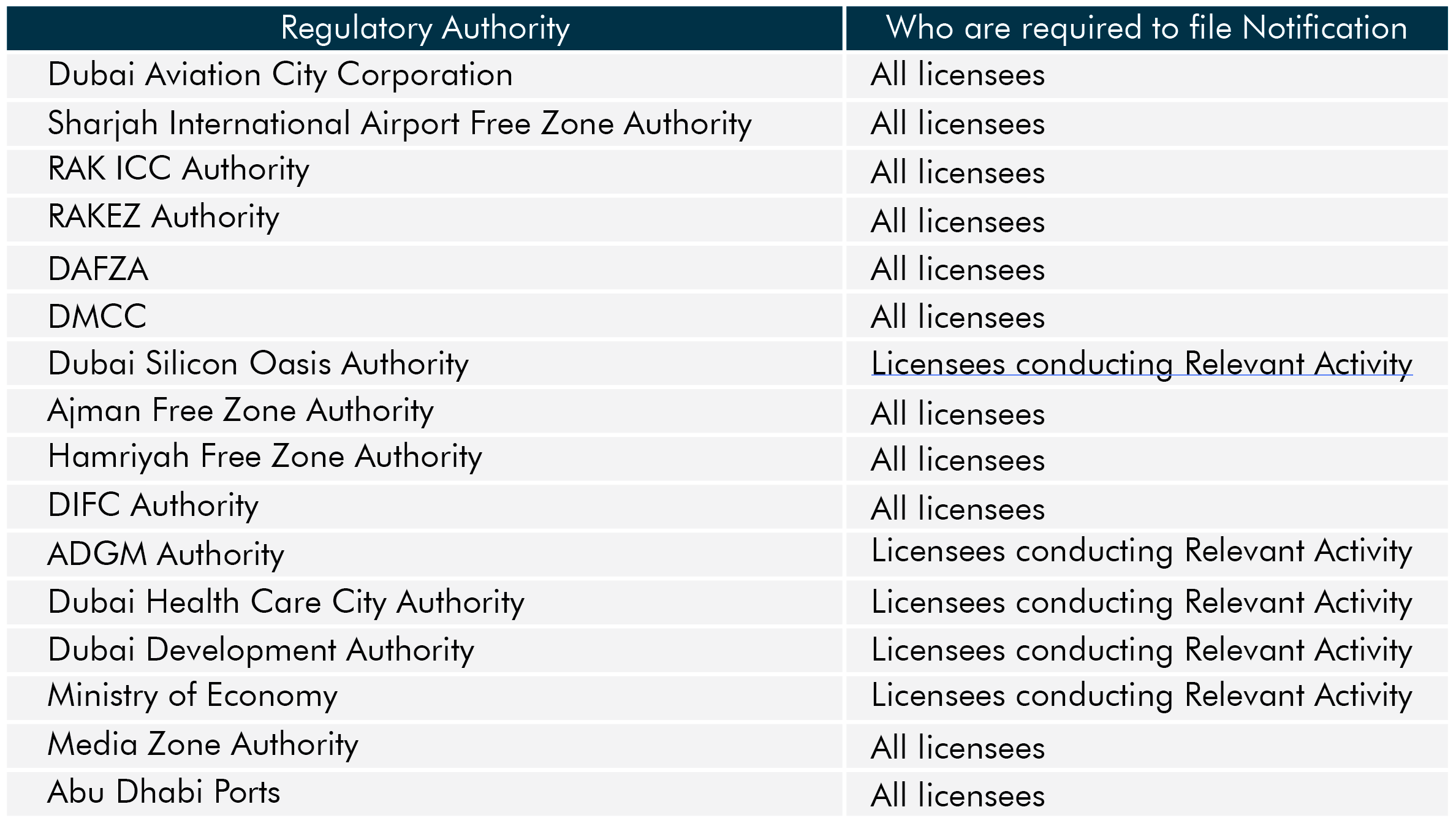

ESR requires all businesses having a commercial license, certificate of incorporation or similar permits issued by any regulatory authority in UAE (licensees) carrying out one or more Relevant Activity to substantiate adequate economic substance in the UAE.

ESR excludes UAE licensees with direct or indirect holding of at least 51% by any UAE Government, Governmental authority and/or body.

Action Points

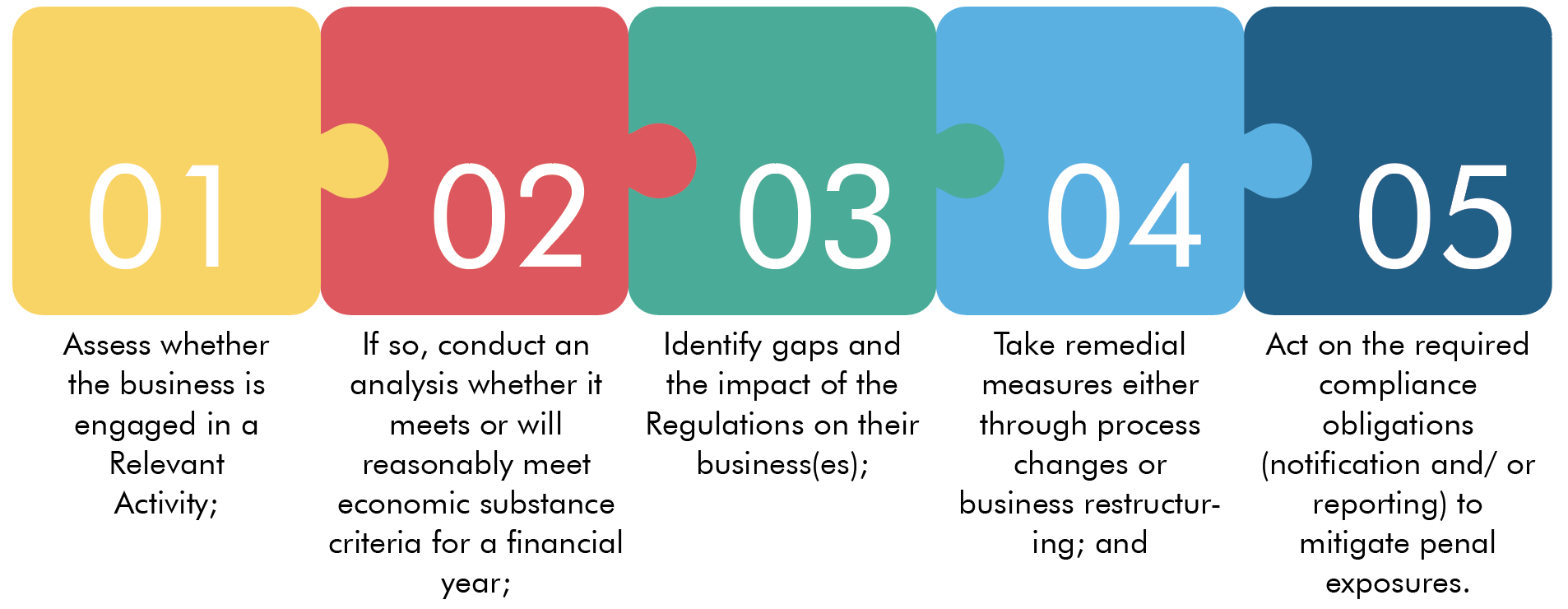

Since the principles of economic substance are largely governed by international best practices (albeit tweaked for local market conditions) and recommendations by the OECD, UAE businesses should:

Penalties for non-compliance with ESR

Non-monetary penal consequences could include suspension, revocation or non-renewal of license in appropriate circumstances.

How Kreston Menon can help you?

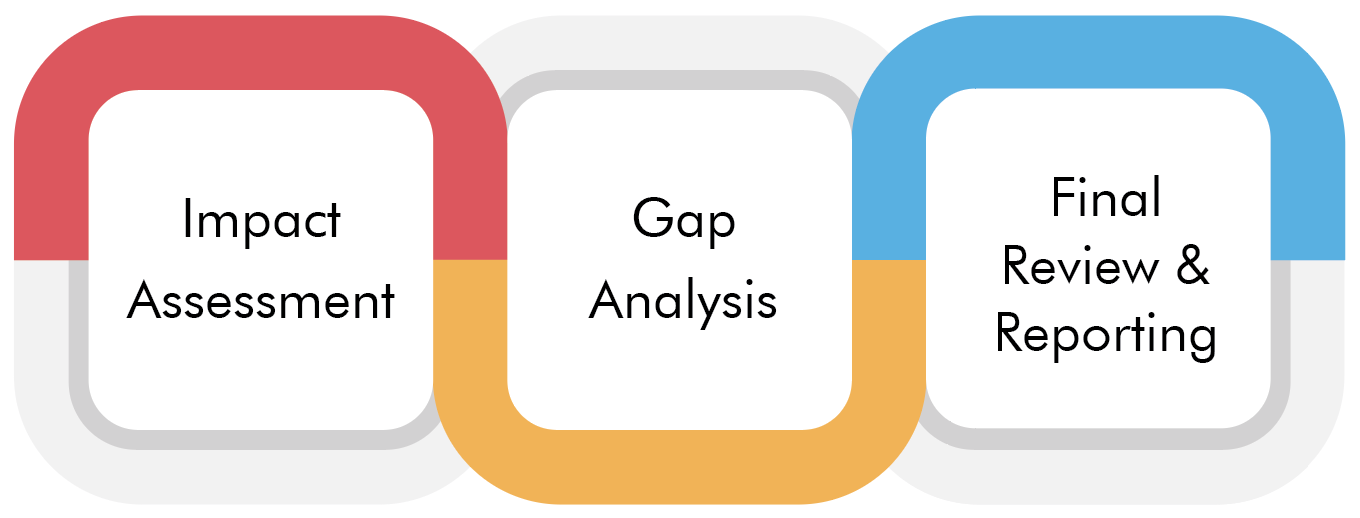

Kreston Menon has a specialized team to provide an end to end solution for impact assessment, gap analysis and reporting obligations for ESR for your business.