Valuing a Tech Company in the Middle East

Imagine you have built a successful tech company in the Middle East, offering technology solutions in the UAE and Saudi Arabia. Years of hard work have paid off, and now a big client, a multinational corporation, wants to buy your business.

But how do you decide the value of what you have achieved? This is the dilemma for the owners of this private tech company as they plan to sell the business they have built from scratch.

The Valuation Challenge

Valuing a private company in an emerging market is not easy. Without stock prices or market consensus, it’s a mix of growth potential, regional factors, and market competition. To navigate this dilemma, the owners enlisted KMEC, a trusted advisor for advisory services, to guide them through two contrasting valuation methods: the forward-looking Discounted Cash Flow (DCF) approach, which looks at the company’s future cash potential, and the EBITDA multiple method, which builds on current earnings strength.

With these valuations, the owners must negotiate with a savvy multinational buyer aiming to enhance its capabilities. Should they go with the optimistic DCF, the realistic EBITDA, or a mix of both? The multinational will examine every detail, but the tech company’s strategic advantage might influence the final price.

This case study explores valuation and negotiation in an emerging market, where ambition meets opportunity, and every decision impacts the outcome—a story of strategy, risk, and seeking fair value in a fast-changing tech world.

Background

The technology company provided enterprise solutions focused on emerging sectors in the region. It had established a solid presence in the UAE and Saudi Arabia, benefiting from the region’s increasing demand for technology solutions. The firm served a diverse client base, including several large multinational companies.

One of these clients, a multinational corporation, had been a significant customer for years. Impressed by the technology company’s solutions and regional expertise, the multinational expressed interest in acquiring it to expand and build its own in-house capabilities. The owners considered this as a good opportunity to exit the business. However, they needed to establish a fair valuation of the business for negotiations.

The Challenge

Valuing a privately held technology company operating in an emerging market is complex. Unlike public companies with market-driven stock prices, these firms lack a clear benchmark. The valuation had to also take into account the organization’s growth potential in a region undergoing digital transformation, while also factoring the risks of a competitive and fast-changing industry.

To address this, the owners approached KMEC, a business consulting firm specializing in business valuations for companies in the Middle East. The firm was engaged to provide a range of valuations to support the owners in the negotiations it could have with the potential buyer.

Valuation Methods

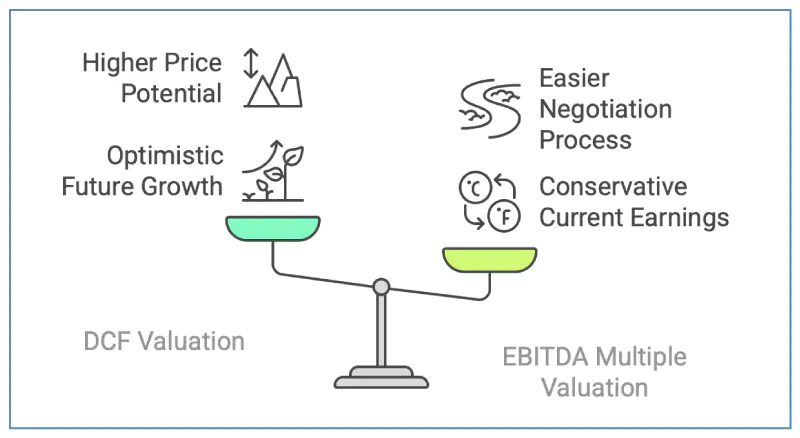

KMEC used two common valuation methods: the Discounted Cash Flow (DCF) method and the EBITDA multiple approach. These methods provide two distinct perspectives on the firm’s value, one focusing on future potential and the other on current earnings respectively.

Discounted Cash Flow (DCF) Method

The DCF method calculates a company’s value based on its projected future cash flows, adjusted to their present value. This approach is suited for companies with a positive growth potential, as it reflects future earnings. KMEC collaborated with the client’s management to prepare credible financial projections. With an in-depth understanding of the market, KMEC was able to derive these forecasts on potential revenue growth that the company could have had from new clients and market expansion. Their understanding of the client’s business helped forecast how improvement of operating margins would contribute to the organization’s future revenue as the business operations scaled. Additionally, a discount rate reflecting the industry’s risk in the region was applied to determine the DCF valuation.

EBITDA Multiple Approach

The EBITDA multiple approach values a business based on its current earnings before interest, taxes, depreciation, and amortization (EBITDA), which is then multiplied by a factor from similar transactions or industry standards. KMEC applied this method to emphasize the company’s value based on current performance. The firm examined acquisitions of comparable technology companies, identifying a typical EBITDA multiple for the technology sector. Using the company’s recent EBITDA, KMEC calculated a valuation with this approach.

Strategic Negotiation

With valuations from both methods, KMEC provided the client with several strategies to negotiate with the potential buyer:

1. Lead with the DCF Valuation: The owners could lead the negotiations with this by highlighting the company’s future growth and long-term value to the buyer, even if this approach presented an optimistic view to the buyer who might be focused on current earnings.

2. Anchor with the EBITDA Multiple Valuation: Another approach would be to present the buyer a conservative figure based on current financials, potentially easing negotiations but also possibly limiting the sale price.

3. Present a Valuation Range: The owners could also choose to present both valuations, proposing a price between the DCF (upper bound) and EBITDA multiple (lower bound), providing them the flexibility and justification for a higher price based on growth potential.

4. Combine the Methods: The owners could also adopt a blended valuation approach, such as taking an average or weighting them based on industry practices, to initiate a starting point for negotiation talks.

Decision Point

As the owners prepared to negotiate with the multinational corporation, they needed to make an informed strategic decision on which valuation approach to emphasize in their discussions. The multinational corporation, being a more sophisticated organization, could possibly scrutinize the assumptions behind the valuations. The owners had to also factor the strategic value that their firm offered the buyer, which could be used to support a higher price.

The key question was: Which valuation method should the owners prioritize in their negotiations with its potential buyer, and how should they justify it to maximize their sale price, while providing credible information to support the value of their business?

Conclusion

This case illustrates the difficulties a privately held technology company faces in valuing its business in an emerging market. The owners’ need was to balance future growth potential against current profitability while engaging in a critical negotiation with a knowledgeable buyer. Their choice of valuation approach will shape the outcome of the sale.