Background and legislative framework

Transfer pricing provisions were introduced in the United Arab Emirates (“UAE”) with the enactment of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses (the “Corporate Tax Law”).

Pursuant to Article 34 of the Corporate Tax Law, all transactions and arrangements between Related Parties and Connected Persons must comply with the Arm’s Length Principle. Further, Article 59 of the Corporate Tax Law permits taxpayers to apply for an Advance Pricing Agreement (“APA”), which enables to set the criteria to determine the Arm’s Length Price in relation to Controlled Transactions entered or to be entered by that Person with its Related Party/Parties, over a fixed period of time.

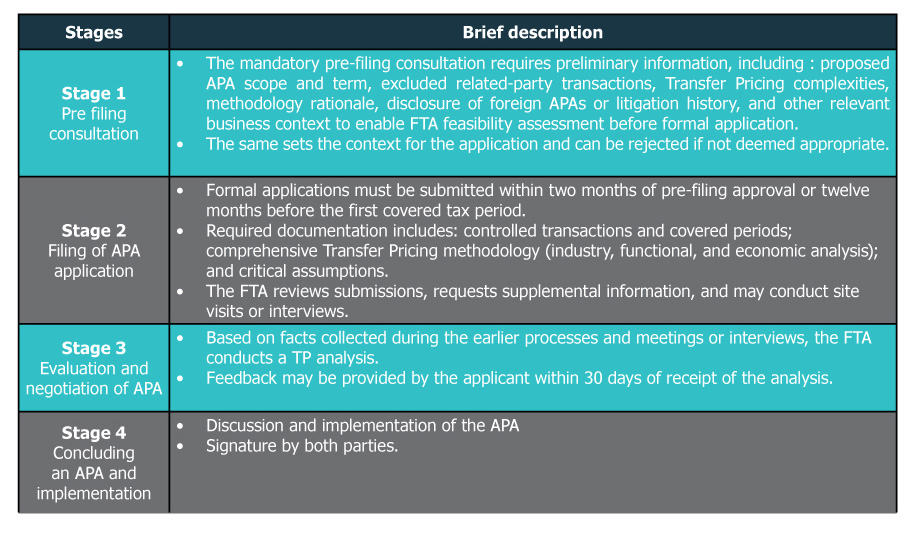

On 31 December 2025, the UAE Federal Tax Authority issued the Advance Pricing Agreements Corporate Tax Guide (hereinafter referred to as “APA Guide”). This guidance sets out the procedural framework for APAs in the UAE, including the scope of the APA programme, eligibility conditions, application process, monitoring and compliance requirements, and the legal effect of an APA once granted.

Overview of the APA Programme

The Advance Pricing Agreement (APA) programme provides a voluntary mechanism for a Person, whether a natural person or a juridical person, to enter into an agreement with the Federal Tax Authority (FTA) to determine the Arm’s Length Price (may include application of one or combination of the TP methods) of Controlled Transactions over a specified period. By establishing agreed Transfer Pricing arrangements in advance, APAs help mitigate the risk of Transfer Pricing disputes and litigation.

The FTA is implementing the APA programme in a phased manner. Initially, the programme focuses on Domestic Unilateral APAs (UAPAs), with applications accepted from December 2025. Cross-border UAPAs will be introduced subsequently, with the commencement date to be announced in 2026 and details of Bilateral and Multilateral APAs will be introduced at a later stage.

Eligibility and Materiality Threshold

A Natural Person or Juridical Person may apply for an Advance Pricing Agreement (APA) if the total or expected value of the domestic and/or cross-border Controlled Transactions is equal to or exceeds AED 100 million in a specific tax period. Controlled Transactions that fall under safe-harbour provisions, including low value-adding intra-group services, are not eligible for coverage under an APA and will be excluded from the threshold calculation.

A non-refundable fee of AED 30,000 per application of a Unilateral APA, and AED 15,000 for amendment or renewal of an existing Unilateral APA applies. The APA may be applied for a minimum of three prospective Tax Periods and a maximum of five prospective Tax Periods.

Benefits of the APA programme

The UAE Advance Pricing Agreement Guide identifies five core benefits that justify programme participation for qualifying taxpayers.

• Enhanced predictability provides multi-year certainty on transfer pricing methodologies, enabling accurate tax forecasting and eliminating retrospective assessment risk across the 3–5 year APA term.

• Facilitated collaboration between the Federal Tax Authority and taxpayers replaces adversarial audit dynamics with cooperative methodology development through structured pre-filing consultation and negotiation processes.

• Prevention of transfer pricing disputes addresses primary multinational concerns: advance FTA acceptance of methodologies reduces audit adjustment risk compared to traditional documentation approaches, simultaneously eliminating controversy management costs.

• Prevention of double taxation becomes achievable through bilateral APAs (yet to be announced), wherein coordinated competent authority agreements ensure consistent treatment across jurisdictions.

• Streamlined compliance delivers quantifiable efficiency: ongoing obligations reduce to critical assumption monitoring rather than annual benchmarking studies, decreasing compliance costs over typical five-year terms while maintaining comprehensive tax certainty and reducing management time devoted to transfer pricing matters.

Way Forward

Considering the presence of Multi National Enterprises in UAE, and the expected beneficiaries of the programme seeking tax certainty, the programme would be expected to undergo a few updates in the due course of time, following other global jurisdictions.

• Rollback Provisions: The UAE initially offers no rollback to cover prior years. Considering the utilisation rate of rollback provisions introduced in other jurisdictions like India and the USA, the said provision represents clear taxpayer demand for historical coverage. This creates a “gap period” where 2024-2025 positions could potentially remain unprotected during the processing period.

• Dispute resolution mechanism: The procedures laid down emphasises on qualitative filtering of applications ensuring effective use of time and resources by way of pre-filing consultation. This envisages situations wherein an application can be rejected at the pre-filing stage or at the application stage. The programme does not lay down procedure for any recourse available to the applicant in the case of any dispute that arises pertaining to such rejection faced.

• Bilateral Capability: The phased rollout means bilateral APAs, essential for complete double taxation protection, would not be available initially. This could lead to potential transitional double taxation losses for Multi National Enterprises, who would be keen to minimise the gap at the earliest.

Conclusion

Through these comprehensive guidelines, the UAE establishes itself as a sophisticated Transfer Pricing jurisdiction. The UAE’s combination of inaugural APA capability, 0% free zone regimes, and 140+ double taxation treaties creates compelling positioning for regional headquarters operations. The programme delivers quantifiable benefits: enhanced predictability for complex Transfer Pricing positions, collaborative authority engagement replacing traditional audit approach, and proactive dispute prevention. For multinationals managing UAE-specific complexities—mainland-free zone structures, regional service arrangements, IP migrations—APAs provide essential certainty transforming compliance obligations into strategic advantages. As the programme matures with bilateral capability development and enhanced transparency, the UAE’s position will strengthen further, cementing its role as the region’s premier destination for Transfer Pricing-supported investment.