I have spent three decades in finance, and I can tell you what is happening right now in the UAE is unlike anything we have seen before. AI is not just another tool in the auditor’s kit. It is fundamentally changing what it means to work in finance.

When policy meets possibility

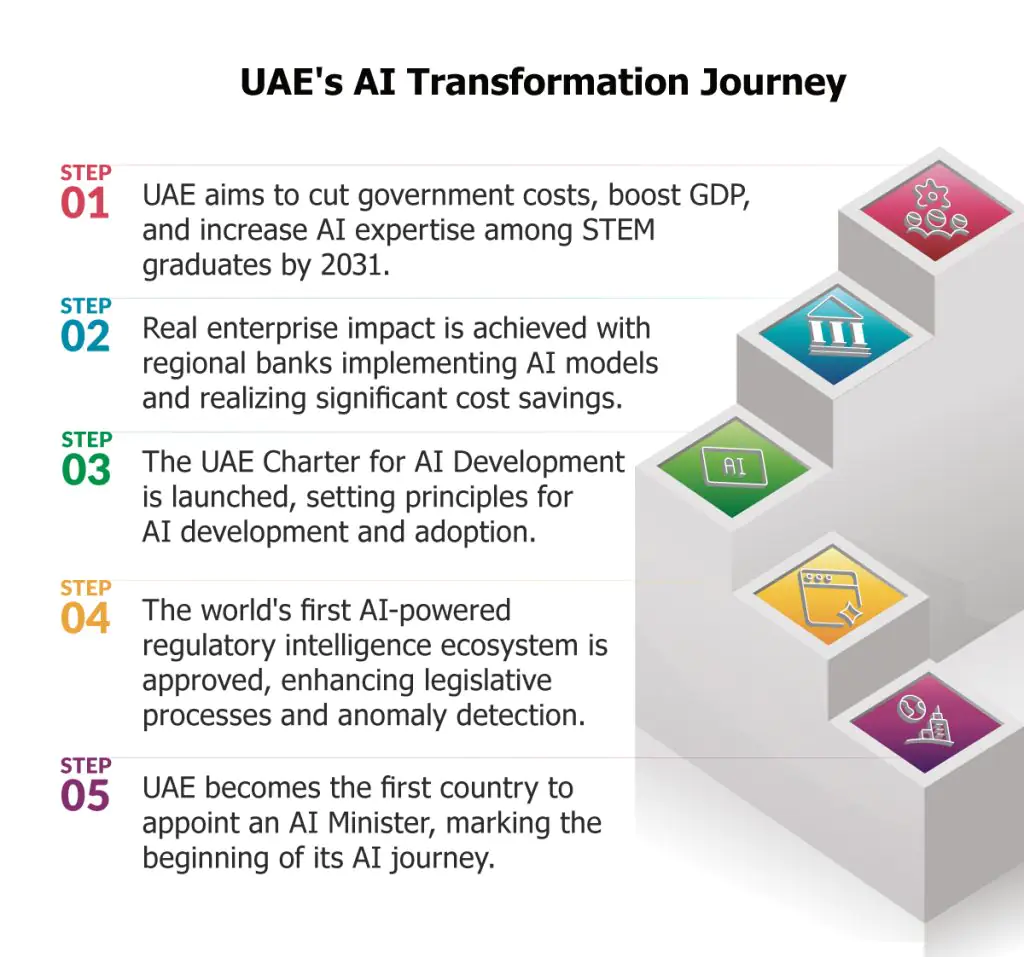

In April this year, something remarkable happened. The UAE Cabinet approved the world’s first AI-powered regulatory intelligence ecosystem. This is not about digitizing forms. It is about creating a system that monitors how laws impact our economy in real-time and can accelerate the entire legislative process by up to 70 percent. Think about what that means for those of us managing compliance. Regulatory changes that used to require weeks of manual review now adapt automatically.

The vision started in 2017 when we became the first country to appoint a Minister of State for Artificial Intelligence. According to the UAE Strategy for Artificial Intelligence 2031, we are aiming to cut government costs by 50 percent while boosting GDP by 35 percent. Those are not aspirational numbers. They are driving real infrastructure investments and regulatory clarity that allows us to move fast.

The creation of the Artificial Intelligence and Advanced Technology Council in January 2024 sent a clear message: this commitment comes from the top. For finance professionals, this matters because we are not experimenting in a regulatory vacuum. We have backing.

What I am seeing in the field

Walk through any major financial institution in Dubai today, and you will notice something different. Teams are smaller, but they are accomplishing more. Machine learning algorithms catch anomalies in financial statements with 95% accuracy, spotting issues that would slip past even the most diligent human reviewer after hours of work. Compliance audits that once took months now finish in 40% less time, with better results.

Look at Emirates NBD. According to McKinsey’s October 2024 analysis, they have built over 100 AI models with a team of 70+ specialists, targeting a five-to-seven times return on their AI investment. They deployed an internal legal tool that answers regulatory queries instantly. This is work that used to consume hours of senior legal counsel time. One regional bank saved AED 1.2 million annually after implementing AI fraud detection that reduced false positives by 40 percent.

These are not pilot projects anymore. This is how work gets done.

The three places AI changes everything

First, document processing. Our multilingual environment used to be a nightmare for standardization. Now AI extracts data from invoices, contracts, and statements across Arabic, English, and multiple other languages in minutes. Junior auditors who spent days on this work are now analyzing trends and advising clients.

Second, risk becomes predictive instead of reactive. We are navigating VAT, Economic Substance Regulations, and the new 9% corporate tax on profits above AED 375,000. AI models spot compliance issues before they become regulatory problems. The Central Bank’s Guidelines for Financial Institutions require transparency and human oversight in AI systems, and the leaders in our space have figured out how to deliver both.

Third, continuous monitoring replaces the month-end scramble. Finance teams get real-time alerts on spending anomalies, cash flow issues, and vendor irregularities. The week-long close process that used to shut down entire departments now runs quietly in the background, all the time.

Infrastructure makes the difference

At GITEX 2024, Dubai’s Financial Audit Authority launched three digital services that show where government auditing is headed. The Al Mo’ashir Dashboard provides live insights from auditing activities across government entities. The Financial Violations Reporting Platform enables instant reporting. This is not about catching problems after the fact. It is about maintaining continuous readiness.

The shift to e-invoicing and digitalized tax systems could have been overwhelming. Instead, AI platforms now reconcile transactions, validate VAT classifications, and flag issues before submission. Compliance has moved from quarterly fire drills to always-on systems.

The human side gets more important

Here is what surprises people: AI has not made finance professionals less important. It has made us more important, just in different ways. The technical knowledge still matters, obviously. But now we are interpreting AI insights, challenging algorithmic assumptions, and translating findings into strategy.

The UAE Charter for the Development and Use of Artificial Intelligence, launched in July 2024, established 12 principles for protecting community rights while enabling innovation. This framework recognizes something critical: as AI handles routine compliance, humans focus on the judgment calls that require experience, ethics, and strategic thinking. That is where the real value lives.

Where we go from here

A regional research shows 49% of UAE organizations actively deploying AI in finance functions, compared to just 35% globally. We are not just ahead. We are defining what is possible. The government’s goal of ensuring one in three STEM graduates have AI expertise by 2031 means this advantage compounds over time.

I have watched enough technology transitions to know this one is different. The companies that treat AI as an experimental side project will spend the next five years catching up to competitors who moved decisively. The regulatory framework supports innovation. The infrastructure exists. The talent is coming.

The only question is whether you are ready to lead this transformation or watch it happen to you. The tools work. The policy environment encourages adoption. Success comes down to leadership.