In a landmark reform aimed at enhancing the business ecosystem and reinforcing Dubai’s status as a global investment hub, Dubai Executive Council has passed a resolution permitting Free Zone companies to do business in the Dubai mainland. This change has the potential to open new markets, bring in new business synergies and facilitate more foreign direct investment into the Emirate.

Let us do a deep dive into what the new resolution entails and how it could benefit businesses.

The Resolution No. (11) of 2025: A definite Step Forward

Dubai Executive Council Resolution No. (11) of 2025 permitting Dubai Free Zone entities to expand their business activities to mainland Dubai through the issuance of onshore licenses and activity permits.

The companies registered in Free Zones were restricted from engaging in commercial activities in the mainland which many considered to be regulatory and financial divide that restrained businesses in an increasingly interconnected environment.

The new resolution aims to bridge that gap. Free Zone companies can now engage with the mainland market directly, subject to compliance with Dubai’s regulatory framework, licensing requirements, and sector-specific approvals. This initiative complements with D33 Agenda – the economic vision of Dubai which aims to double the size of economy, which will position Dubai as one of the three global cities for business and innovation.

The Mechanism

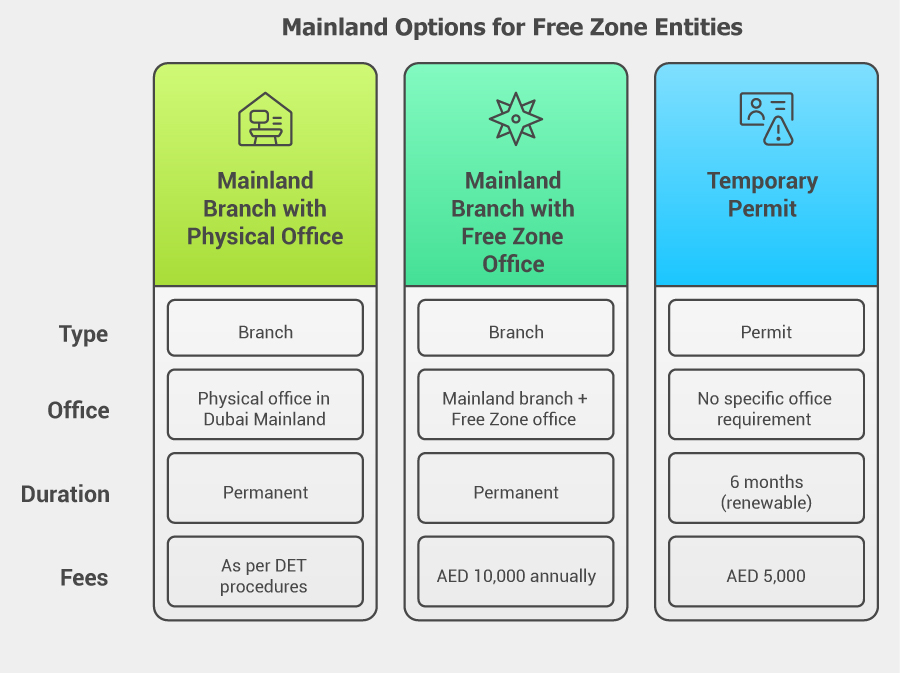

Free Zone entities who are looking to take advantage of the new resolution which will be integrating Free Zones and Mainland, may apply for one of the three new types of licenses/permits:

Option-1 Branch with office in Dubai Mainland: Setting up a Branch of the Free Zone entity in accordance with the branch registration procedures with a physical office within Dubai proper.

Option-2 Continuing with Free Zone Office: Setting up a Branch of the Free Zone entity in accordance with the branch registration procedures while continuing with its Free Zone office.

Option-3 Temporary Permit for short term activities: Temporary permit for the Free Zone entity to operate some activities within Dubai for a period of six months with a provision of renewal for a similar period.

External Approval: The branch entity, depending on the intended activities, shall be subject to relevant external department/ministry approval prior to obtaining DET license/Permission.

The Process

The first step for the business is to obtain necessary No-objection Certificate (NOC) from the Free Zone Authority they are currently operating from. The authorities have made the process easier.

Once the NOC is received, the documents certified by the Free Zone entity can be submitted for the license.

Visa and Work Permit

The branch is permitted to register with MOHRE and GDFRA for work permits and visas for their employees.

Financial Records

Free Zone entities licensed or permitted under the Resolution must maintain distinct financial records of its operations conducted in the Dubai mainland.

Corporate Taxation

Free Zone entities licensed or permitted under this Resolution shall be subject to 9% corporate tax, if the taxable income exceeds AED 375,000. Conditions for the Qualifying Free Zone Person (QFZP) regime may also be explored in certain cases.

List of Activities

The Resolution provides that the DET, in coordination with the relevant licensing authorities, will issue a list of economic activities that Free Zone businesses can conduct in Dubai.

Substance

DET further assesses substance of the Free Zone entity before issuing the permission to operate in Dubai Mainland.

Limited to Free Zone entities from Dubai

According to the new resolution, only entities registered in Free Zones located in Dubai are permitted to open the branch or apply for permission to operate in the Mainland.

5 Key Advantages of the New Resolution

1. Expanded Market Reach for Free Zone Entities

This resolution opens the vibrant domestic market of Dubai’s Mainland giving Free Zone entities access to more businesses and consumers. This could benefit companies that are in retail, logistics, professional services and many more.

2. Simplified Regulatory Landscape

The initiative has a more streamlined approach compared to the earlier complex issue of setting up separate free Zone and Mainland entities and navigating two different legal frameworks of the jurisdictions. This is a stride forward to the ease of doing business initiatives of Dubai.

3. Attractive for FDIs

The new resolution cements Dubai’s reputation as the most preferred global investment destination. The change sends a strong investor friendly message to global investors that Dubai is committed to remove any barriers that can hinder the growth of businesses in the emirate.

4. Drive Collaboration and Innovation

The resolution will drive greater integration between Free Zone and Mainland companies, and that will stimulate a more collaborative business culture. Companies operating in specialized Free Zones now have the opportunity to explore possibilities of strategic alliances and partnerships with businesses in the Mainland, by having cross sector collaboration avenues with the future technology companies in Fintech, Healthtech, Security, Artificial Intelligence and Green Energy.

5. Boost to Economic Resilience

Allowing Free Zone entities to scale up by giving access to the Mainland, Dubai aims to solidify their efforts to diversify the economy. As businesses extend their reach and invest more in infrastructure and human capital, the ripple effects are bound to make the economy more resilient.

Final Words

Giving Free Zone companies access to the Mainland is not just a policy tweak — it’s a strategic shift.

As the specifics of the resolution continue to roll out, Kreston Menon is interacting with the authorities to see how best we can equip our clients to leverage the new opportunities.